As filed with the Securities and Exchange Commission on December 20, 2013

Registration No. 333-192232

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT

NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AMEDICA CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 3841 | 84-1375299 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

1885 West 2100 South

Salt Lake City, UT 84119

(801) 839-3500

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Eric K. Olson

Chief Executive Officer

Amedica Corporation

1885 West 2100 South

Salt Lake City, UT 84119

(801) 839-3500

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

With copies to:

| Jonathan L. Kravetz, Esq. Anthony E. Hubbard, Esq. Daniel T. Kajunski, Esq. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. One Financial Center Boston, MA 02111 (617) 542-6000 |

Babak Yaghmaie Darren K. DeStefano Charles S. Kim Cooley LLP 1114 Avenue of the Americas New York, NY 10036 (212) 479-6000 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (the “Securities Act”), check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

| Large accelerated filer ¨ |

Accelerated filer ¨ | |

| Non-accelerated filer x (Do not check if a smaller reporting company) |

Smaller reporting company ¨ | |

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell securities, and we are not soliciting offers to buy these securities, in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 20, 2013

PRELIMINARY PROSPECTUS

Shares

Common Stock

$ per share

Amedica Corporation is offering shares of its common stock. This is our initial public offering and no public market currently exists for our shares. We anticipate that the initial public offering price of our common stock will be between $ and $ per share.

We have applied to have our common stock listed on The NASDAQ Global Market under the symbol “AMDA.”

We are an “emerging growth company” as defined under the Jumpstart Our Business Startups Act of 2012, and as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

We have granted the underwriters an option for a period of 30 days to purchase up to an additional shares of common stock.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 10.

| Per Share | Total | |||||

| Public offering price |

$ | $ | ||||

| Underwriting discount(1) |

$ | $ | ||||

| Proceeds, before expenses, to us |

$ | $ | ||||

| (1) | We refer you to “Underwriting” beginning on page 130 of this prospectus for additional information regarding total underwriting compensation. |

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2013.

Neither the Securities and Exchange Commission nor any state securities regulators has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| JMP Securities | ||||

| Needham & Company | ||||

The date of this prospectus is , 2013.

| Page | ||||

| 1 | ||||

| 10 | ||||

| 35 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

46 | |||

| 66 | ||||

| 92 | ||||

| 97 | ||||

| 108 | ||||

| 116 | ||||

| 118 | ||||

| 123 | ||||

| Material U.S. Federal Tax Consequences for Non-U.S. Holders of Common Stock |

126 | |||

| 130 | ||||

| 136 | ||||

| 136 | ||||

| 136 | ||||

| F-1 | ||||

Through and including , 2014 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This delivery is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus. Neither we nor any of the underwriters has authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any free writing prospectus prepared by or on behalf of us or to which we may have referred you in connection with this offering. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor any of the underwriters is making an offer to sell or seeking offers to buy these securities in any jurisdiction where or to any person to whom the offer or sale is not permitted. The information in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock, and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus. Our business, financial condition, results of operations and future growth prospects may have changed since those dates.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, we have not independently verified such data.

For investors outside the United States: neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any free writing prospectus outside of the United States.

This summary highlights information contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially “Risk Factors” and our consolidated financial statements and the related notes included in this prospectus. Unless the context requires otherwise, references to “Amedica,” “we,” “our” and “us” in this prospectus refer to Amedica Corporation and its subsidiary.

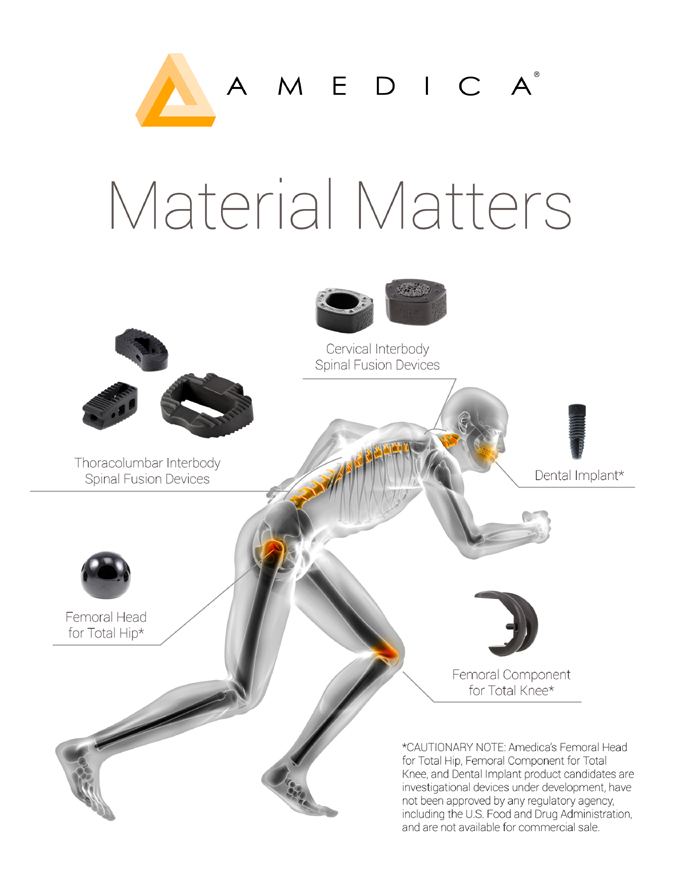

Amedica Corporation

Our Company

We are a commercial biomaterial company focused on using our silicon nitride technology platform to develop, manufacture and sell a broad range of medical devices. We currently market spinal fusion products and are developing products for use in total hip and knee joint replacements. We believe our silicon nitride technology platform enables us to offer new and transformative products in the orthopedic and other medical device markets. We believe we are the first and only company to use silicon nitride in medical applications and over 14,000 of our silicon nitride spine products have been implanted in patients.

Biomaterials are synthetic or natural materials available in a variety of forms that are used in virtually every medical specialty. We believe our silicon nitride biomaterial has superior characteristics compared to commonly used biomaterials in the markets we are targeting, including polyetheretherketone, or PEEK, which is the most common biomaterial used for interbody spinal fusion products. Specifically, we believe our silicon nitride has the following key attributes: promotion of bone growth; hardness, strength and resistance to fracture; resistance to wear; non-corrosive; anti-infective properties; and superior diagnostic imaging compatibility.

We currently market our Valeo family of silicon nitride interbody spinal fusion devices in the United States and Europe for use in the cervical and thoracolumbar areas of the spine. We believe our Valeo devices have a number of advantages over existing products due to silicon nitride’s key characteristics, resulting in faster and more effective fusion and reduced risk of infection. To date, the rate of adverse events reported to the U.S. Food and Drug Administration, or FDA, for our implanted Valeo interbody spinal fusion devices is 0.1%.

In addition to our silicon nitride-based spinal fusion products, we market a complementary line of non-silicon nitride spinal fusion products which allows us to provide surgeons and hospitals with a broader range of products. These products include three lines of spinal fusion devices and five types of orthobiologics, which are used by surgeons to help promote bone growth and fusion in spinal fusion procedures. Although our non-silicon nitride products have accounted for approximately 70% or more of our product revenues for the years ended December 31, 2012 and 2011 and the nine months ended September 30, 2013, we believe the continued promotion and potential for adoption of our silicon nitride products and product candidates, if approved, provides us the greatest opportunity to grow our business in new and existing markets and achieve our goal to become a leading biomaterial company.

We are also incorporating our silicon nitride technology into components for use in total hip and knee replacement product candidates that we are, or plan on, developing in collaboration with a strategic partner. We believe that our silicon nitride total hip and knee product candidates will provide competitive advantages over current products made with traditional biomaterials. We believe our silicon nitride technology platform can be used for developing products in other markets and have developed prototypes for use in the dental, sports medicine and trauma markets. As a result of some of the key characteristics of our silicon nitride, we also believe our coating technology may be used to enhance our metal products as well as commercially available metal spinal fusion, joint replacement and other medical products.

1

We operate a 30,000 square foot manufacturing facility located at our corporate headquarters in Salt Lake City, Utah, and we are the only vertically integrated silicon nitride orthopedic medical device manufacturer in the world. We market and sell our products to surgeons and hospitals in the United States and select markets in Europe and South America through our established network of more than 50 independent sales distributors who are managed by our experienced in-house sales and marketing management team.

Market Opportunity

Our products and product candidates target the interbody spinal fusion and total hip and knee joint replacement markets. According to iData Research, Inc., in 2012, the markets for spinal implants in the United States and in combined major European markets were $5.3 billion and $1.0 billion, respectively. Interbody spinal fusions accounted for over $1.2 billion and $172.2 million of these markets, respectively. Additionally, Orthopedic Network News reported that the U.S. markets for the components of total hip and knee replacement product candidates that we are initially developing were $455.0 million and $1.5 billion, respectively.

Our Silicon Nitride Technology Platform

We believe our silicon nitride, an advanced ceramic, is ideally suited for use in many medical applications and has the following characteristics that make it superior to other biomaterials, which do not possess all of these characteristics:

| • | Promotes Bone Growth. The biomaterials used in interbody spinal fusion devices should promote bone growth in and around the device to further support fusion and stability. Our silicon nitride has an inherent surface chemistry and topography which creates an ideal environment for the promotion of new bone growth. |

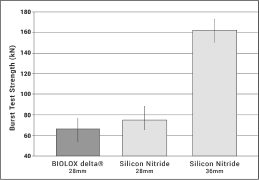

| • | Hard, Strong and Resistant to Fracture. The biomaterials used in interbody spinal fusion devices and joint replacement implants should be strong and resistant to fracture during implantation of the device and withstand the static and dynamic forces exerted on the spine or to adequately bear the significant loads placed on joints during daily activities. Biomaterials used in joint replacements should also be resistant to deformation, which is referred to as hardness. We believe our silicon nitride is hard, strong and resistant to fracture. |

| • | Anti-Infective. Infection is a serious problem in orthopedic surgery and treating device-related infection generally requires extensive repeat surgery, including replacement, or revision, surgery, which extends patient suffering and increases costs. We have demonstrated in in vitro and in vivo studies that our silicon nitride has inherent anti-infective properties, which reduce the risk of infection in and around a silicon nitride device. We demonstrated that live bacteria counts were between 8 to 30 times lower on silicon nitride than PEEK and up to 8 times lower on silicon nitride than titanium, another commonly used biomaterial. |

| • | Imaging Compatible. The biomaterials used in interbody spinal fusion devices should be visible through, and not inhibit the effective use of, common surgical and diagnostic imaging techniques, such as x-ray, CT and MRI. Our silicon nitride interbody spinal fusion devices are semi-radiolucent and clearly visible in x-rays, and produce no distortion under MRI and no scattering under CT. These characteristics enable an exact view of the device for precise intra-operative placement and post-operative bone fusion assessment in spinal fusion procedures. We believe these qualities provide surgeons with greater certainty of outcomes with our silicon nitride devices than with other biomaterials, such as PEEK and metals. |

| • | Resistant to Wear. The biomaterials used in joint replacement procedures should have sufficient hardness and toughness, as well as extremely smooth surfaces, to effectively resist wear. Because the articulating implants move against each other, they are subject to friction and cyclic loading, which frequently lead to abrasive wear and fatigue failure. We believe joint implants incorporating our silicon nitride components will have comparable or higher resistance to wear than the two most commonly used combinations of biomaterials in total hip replacement implants. |

| • | Non-Corrosive. Biomaterials should be non-corrosive and should not cause adverse patient reactions. Metal placed in the human body corrodes over time and also results in the release of metal ions that can cause |

2

| serious adverse reactions and conditions. Our silicon nitride does not have the drawbacks associated with the corrosive nature of metal within the body nor does it result in the release of metal ions into the body. |

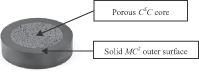

We produce silicon nitride in four forms: (1) a fully dense, load-bearing solid, referred to as MC2; (2) a porous bone-like cancellous structured form, referred to as CSC; (3) a composite incorporating both our solid MC2 material and our porous CSC material intended to promote an ideal environment for bone growth; and (4) a coating for application onto other biomaterials. This capability provides us with the ability to utilize our silicon nitride in distinct ways depending on its intended application, which, together with our silicon nitride’s key characteristics, distinguishes us from manufacturers of other biomaterials and our products from products using other biomaterials.

Our Competitive Strengths

We believe we can use our silicon nitride technology platform to become a leading biomaterial company and have the following principal strengths:

| • | Sole Provider of Silicon Nitride Medical Devices. We believe we are the only company that designs, develops, manufactures and sells medical grade silicon nitride-based products. |

| • | In-House Manufacturing Capabilities. We operate a 30,000 square foot manufacturing facility located at our corporate headquarters in Salt Lake City, Utah. This state-of-the-art facility allows us to rapidly design and produce silicon nitride products and control the entire manufacturing process from raw material to finished goods. We are also party to a cooperative research and development agreement with Kyocera Industrial Ceramics Corporation, or Kyocera, under which we will work with Kyocera to determine its ability to become a second qualified manufacturer of our silicon nitride-based spinal fusion products and product candidates. |

| • | Established Commercial Infrastructure. We market and sell our products to surgeons and hospitals in the United States and select markets in Europe and South America through our established network of more than 50 independent sales distributors who are managed by our experienced in-house sales and marketing management team. |

| • | Portfolio of Non-Silicon Nitride Products. We offer a full suite of spinal fusion products, which increases our access to surgeons and hospitals and allows us to more effectively market our silicon nitride spinal fusion products to our customers. |

| • | Highly Experienced Management and Surgeon Advisory Team. We have recently assembled a senior management team with over 150 years of collective experience in the healthcare industry. Members of our management team have experience in product development, launching of new products into the orthopedics market and selling to hospitals through direct sales organizations, distributors, manufacturers and other orthopedic companies. We also collaborate with a network of leading surgeon advisors in the design, development and use of our products and product candidates. |

Our Strategy

Our goal is to become a leading biomaterial company focused on using our silicon nitride technology platform to develop, manufacture and commercialize a broad range of medical devices. Key elements of our strategy to achieve this goal are the following:

| • | Drive Further Adoption of our Silicon Nitride Interbody Spinal Fusion Devices. We believe that increasing the awareness of our silicon nitride technology by educating surgeons about its key benefits, and the design improvements to our silicon nitride products and related instruments, will accelerate the adoption of our products and ultimately help improve patient outcomes. To drive further awareness of our products and the associated benefits offered by our silicon nitride technology, we will continue to educate surgeons through multiple channels, including industry conferences and meetings, media outlets and through our sales and marketing efforts. |

| • | Continue to Implement our Design and Build Program. In the first half of 2013, we initiated a commercialization strategy, referred to as our Design and Build Program, in which we collaborate with |

3

| influential surgeons to develop customized silicon nitride spinal fusion products and instruments. We first sell these products to the designing surgeons and a team of evaluating surgeons. After evaluation and acceptance by these surgeons, we plan to introduce these products more broadly into the market. The first products designed under this program were sold for initial evaluation in the third quarter of 2013. |

| • | Enhance our Commercial Infrastructure. We expect to increase the productivity of our sales and marketing team by continuing to engage experienced independent sales distributors with strong orthopedic surgeon relationships. For example, in October 2013, we entered into a new European sales agent agreement with K2M, Inc., one of the largest privately held spinal device companies in the world. We may also establish distribution collaborations in the United States and abroad when access to large or well-established sales and marketing organizations may help us gain access to new markets, increase sales in our existing markets or accelerate market penetration for selected products. |

| • | Develop Silicon Nitride for Total Joint Components. We are incorporating our silicon nitride technology into components for use in total hip and knee replacement product candidates that we are, or plan on, developing in collaboration with a strategic partner. We are planning to confirm our regulatory strategy in the United States with the FDA for our total hip implant product candidates by the end of 2013. We plan to conduct a clinical trial for the first of our two designs of hip implant product candidates to obtain FDA clearance and plan to meet with the FDA in the fourth quarter of 2013 to determine the regulatory pathway for the second design. We expect to make a determination about the timing of the further development of both of these designs after the meeting with the FDA. |

| • | Apply our Silicon Nitride Technology Platform to Other Opportunities. Our silicon nitride technology platform is adaptable and we believe it may be used to develop products to address other significant opportunities, such as in the dental, sports medicine and trauma markets. We have manufactured prototypes of dental implants, sports medicine and trauma products, and we have developed a process to coat metals with our silicon nitride to enhance current medical devices and instruments. We plan to collaborate with other companies to develop and commercialize any future products in those areas or develop any one of them ourself should sufficient resources become available. |

Risks Associated with Our Business

Our business is subject to a number of risks that you should be aware of before making an investment decision. These risks are discussed more fully in the section of this prospectus entitled “Risk Factors” immediately following this prospectus summary. You should read these risks before you invest in our common stock. We may be unable, for many reasons, including those that are beyond our control, to implement our business strategy. In particular, risks associated with our business include:

| • | our accumulated deficit as of September 30, 2013, of $140.6 million, and we expect we will continue to incur additional, and possibly increasing, losses, which, among other things, raises doubts about our ability to continue as a going concern; |

| • | our success depends on our ability to successfully commercialize silicon nitride-based medical devices, which to date have experienced only limited market acceptance and may not be widely accepted by hospitals and surgeons in the future; |

| • | we may not be able to increase the productivity of our sales and marketing infrastructure to successfully penetrate the spinal fusion market; |

| • | our long-term success depends substantially on our ability to obtain regulatory clearance or approval of our product candidates and then successfully commercializing these product candidates; |

| • | the orthopedic market is highly competitive and we may not be able to compete effectively against the larger, well-established companies that dominate this market or emerging and small innovative companies; and |

| • | we and our independent registered public accounting firm have identified material weaknesses and a significant deficiency in our internal control over financial reporting, which increases the risk of material misstatements in our future financial statements. |

4

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933 or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable, in general, to public companies that are not emerging growth companies. These provisions include:

| • | reduced disclosure about our executive compensation arrangements; |

| • | no requirement to hold non-binding stockholder advisory votes on executive compensation or golden parachute arrangements; |

| • | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting; and |

| • | reduced disclosure of financial information in this prospectus, including two years of audited financial information and two years of selected financial information. |

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues as of the end of a fiscal year, if we are deemed to be a large-accelerated filer under the rules of the Securities and Exchange Commission, or if we issue more than $1.0 billion of non-convertible debt over a three-year-period.

The JOBS Act also permits us, as an emerging growth company, to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies and thereby allows us to delay the adoption of those standards until those standards would apply to private companies. We are electing to use this extended transition period under the JOBS Act. As a result, our financial statements may not be comparable to the financial statements of issuers who are required to comply with the effective dates for new or revised accounting standards that are applicable to public companies.

Corporate Information

We were incorporated in Delaware in 1996 under the name Amedica Corp. and have since changed our name to Amedica Corporation. Effective September 20, 2010, we acquired all of the outstanding shares of US Spine, Inc. which then became our wholly-owned subsidiary, which is our only subsidiary. Our principal executive offices are located at 1885 West 2100 South, Salt Lake City, Utah 84119, and our telephone number is (801) 839-3500. Our web site address is www.amedicacorp.com. The information on, or that may be accessed through, our web site is not incorporated by reference into this prospectus and should not be considered a part of this prospectus.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

“Amedica,” “CSC,” “MC2,” “Valeo” and “rethink what’s possible” are registered U.S. trademarks of Amedica Corporation. “US Spine” is a registered U.S. trademark of our subsidiary, US Spine, Inc. All other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. Trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols for convenience. Such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable

licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

5

THE OFFERING

| Common stock offered by us |

shares (or shares if the underwriters exercise in full their option to purchase additional shares) |

| Common stock to be outstanding after this offering |

shares (or shares if the underwriters exercise in full their option to purchase additional shares) |

| Option to purchase additional shares |

We have granted to the underwriters the option, exercisable for 30 days from the date of this prospectus, to purchase up to additional shares of common stock. |

| Use of proceeds |

We intend to use the net proceeds from this offering (i) to continue to build sales, marketing and distribution capabilities for our silicon nitride technology platform, including the costs of inventory and instruments, (ii) to fund research and development and commercialization activities of our product candidates, including the funding of clinical trials we plan to conduct for our product candidates, and (iii) to support working capital needs and other general corporate purposes, including debt service under our existing term loan and credit facility with General Electric Capital Corporation and Zions First National Bank. See “Use of Proceeds.” |

| Offering price |

$ per share |

| Risk factors |

See “Risk Factors” beginning on page 10 and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our common stock. |

| Proposed NASDAQ Global Market symbol |

AMDA |

The number of shares of our common stock to be outstanding after this offering is based on 15,406,651 shares of common stock outstanding as of September 30, 2013, and assumes the conversion of all of our shares of convertible preferred stock outstanding as of September 30, 2013 into shares of common stock upon the completion of this offering. It does not include:

| • | 2,436,968 shares of common stock issuable upon the exercise of outstanding options to purchase common stock as of September 30, 2013 under our 2003 Stock Option Plan, or the 2003 Plan, at a weighted-average exercise price of $1.14 per share; |

| • | 2,344,731 shares of common stock issuable upon the exercise of warrants for shares of Series C, Series D, Series E and Series F convertible preferred stock, on an as converted basis, outstanding as of September 30, 2013, at a weighted-average exercise price of $2.30 per share; |

6

| • | 12,215,928 shares of common stock issuable upon the exercise of warrants for shares of our common stock outstanding as of September 30, 2013, at a weighted-average exercise price of $1.09 per share; |

| • | 3,188,850 shares of common stock issuable upon the vesting of outstanding restricted stock units, or RSUs, issued under our 2012 Equity Incentive Plan, or the 2012 Plan, outstanding as of September 30, 2013; and |

| • | 4,344,386 additional shares of common stock reserved for issuance under the 2012 Plan. |

Unless otherwise indicated, all information contained in this prospectus:

| • | assumes the underwriters do not exercise their option to purchase up to an additional shares of our common stock; |

| • | reflects a 1-for- reverse split of our common stock to be effected prior to the completion of this offering; |

| • | reflects the automatic conversion of all of our outstanding shares of convertible preferred stock into shares of common stock upon completion of this offering, based on an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the front cover of this prospectus); |

| • | reflects the conversion of all outstanding warrants exercisable for shares of preferred stock into warrants exercisable for shares of common stock upon completion of this offering; and |

| • | assumes the adoption of our amended and restated certificate of incorporation and amended and restated bylaws upon the completion of this offering. |

7

SUMMARY CONSOLIDATED FINANCIAL DATA

The summary consolidated financial data set forth below should be read in conjunction with our consolidated financial statements and the related notes, “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

We derived the summary consolidated statement of comprehensive loss data for the fiscal years ended December 31, 2011 and 2012 from our audited consolidated financial statements appearing elsewhere in this prospectus. We derived the summary consolidated statement of comprehensive loss data for the nine months ended September 30, 2012 and 2013 and consolidated balance sheet data as of September 30, 2013 from our unaudited consolidated financial statements appearing elsewhere in this prospectus.

| Years Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2011 | 2012 | 2012 | 2013 | |||||||||||||

| (unaudited) | ||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||

| Consolidated Statement of Comprehensive Loss Data: |

||||||||||||||||

| Product revenue |

$ | 20,261 | $ | 23,065 | $ | 17,126 | $ | 16,604 | ||||||||

| Cost of revenue |

||||||||||||||||

| Product revenue |

4,088 | 5,423 | 3,363 | 4,235 | ||||||||||||

| Write-down of excess and obsolete inventory |

— | 1,043 | — | 778 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of revenue |

4,088 | 6,466 | 3,363 | 5,013 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

16,173 | 16,599 | 13,763 | 11,591 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses |

||||||||||||||||

| Research and development |

7,789 | 6,013 | 4,488 | 2,866 | ||||||||||||

| General and administrative |

7,263 | 7,313 | 5,458 | 4,067 | ||||||||||||

| Sales and marketing |

17,145 | 17,094 | 11,944 | 12,123 | ||||||||||||

| Impairment loss on intangible assets |

— | 15,281 | — | — | ||||||||||||

| Change in fair value of contingent consideration |

4,832 | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

37,029 | 45,701 | 21,890 | 19,056 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(20,856 | ) | (29,102 | ) | (8,127 | ) | (7,465 | ) | ||||||||

| Other income (expense) |

||||||||||||||||

| Interest income |

72 | 57 | 45 | 13 | ||||||||||||

| Interest expense |

(3,456 | ) | (5,611 | ) | (3,864 | ) | (1,345 | ) | ||||||||

| Loss on extinguishment of debt |

— | (251 | ) | — | — | |||||||||||

| Change in fair value of preferred stock warrants |

308 | (85 | ) | (110 | ) | 73 | ||||||||||

| Change in fair value of common stock warrants |

172 | (618 | ) | 1,348 | (224 | ) | ||||||||||

| Other income / (expense) |

9 | (151 | ) | (4 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other expense |

(2,895 | ) | (6,659 | ) | (2,585 | ) | (1,483 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other expense, net |

||||||||||||||||

| Net loss before income taxes |

(23,751 | ) | (35,761 | ) | (10,712 | ) | (8,948 | ) | ||||||||

| Income tax benefit |

— | 726 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (23,751 | ) | $ | (35,035 | ) | $ | (10,712 | ) | (8,948 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other comprehensive loss, net of tax: |

||||||||||||||||

| Unrealized gain / (loss) on marketable securities |

(23 | ) | 25 | 35 | (2 | ) | ||||||||||

| Total comprehensive loss |

$ | (23,774 | ) | $ | (35,010 | ) | $ | (10,677 | ) | $ | (8,950 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share attributable to common stockholders |

||||||||||||||||

| Basic and diluted(1) |

$ | (2.65 | ) | $ | (3.90 | ) | $ | (1.19 | ) | $ | (0.68 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used to calculate net loss attributable to common stockholders |

||||||||||||||||

| Basic and diluted(1) |

8,966 | 8,984 | 8,982 | 13,074 | ||||||||||||

| Pro forma net loss per share attributable to common stockholders (unaudited) |

||||||||||||||||

| Basic and diluted(1) |

||||||||||||||||

|

|

|

|

|

|||||||||||||

| Weighted-average shares used to calculate pro forma net loss per share attributable to common stockholders (unaudited) |

||||||||||||||||

| Basic and diluted(1) |

||||||||||||||||

|

|

|

|

|

|||||||||||||

| (1) | See Note 1 to our consolidated financial statements included elsewhere in this prospectus for an explanation of the method used to calculate the historical and pro forma net loss per share, basic and diluted, and the number of shares used in the computation of the per share amounts. |

8

| As of September 30, 2013 | ||||||||||||

| (unaudited) | ||||||||||||

| (in thousands) | ||||||||||||

| Actual | Pro Forma(1) | Pro

Forma as Adjusted (1)(2) |

||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash, restricted cash and cash equivalents(3) |

$ | 7,861 | $ | $ | ||||||||

| Working capital |

(1,708 | ) | ||||||||||

| Total assets |

35,569 | |||||||||||

| Long-term debt, including current portion |

17,917 | |||||||||||

| Convertible preferred stock |

161,456 | — | — | |||||||||

| Total stockholders’ equity (deficit) |

(153,896 | ) | ||||||||||

| (1) | The pro forma balance sheet data above reflect our unaudited capitalization as of September 30, 2013, on a pro forma basis giving effect to (i) the automatic conversion of all outstanding shares of convertible preferred stock into an aggregate of shares of our common stock upon the completion of this offering, and (ii) the conversion of all outstanding warrants to purchase shares of our convertible preferred stock into warrants to purchase an aggregate of shares of our common stock (but not assuming the exercise of the common stock warrants) and the related reclassification of the preferred stock warrant liability to additional paid-in-capital upon the completion of this offering. |

| (2) | The pro forma as adjusted balance sheet data above reflects the issuance of shares of our common stock upon the completion of this offering at an assumed initial public offering price of $ per share (the midpoint of the price range on the front cover of this prospectus) after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, as if this offering occurred on September 30, 2013. |

| (3) | Restricted cash consists of cash we receive from payments of our accounts receivables held in a segregated account that must be applied to pay amounts owed under our revolving credit facility. |

9

An investment in shares of our common stock involves a high degree of risk. You should carefully read and consider the risks described below, as well as the other information in this prospectus, including our financial statements and the related notes, before deciding to invest in our common stock. The occurrence of any of the following risks could have a material adverse effect on our business, financial condition, results of operations or cash flows. In that case, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Business and Strategy

We have incurred net losses since our inception and anticipate that we will continue to incur substantial net losses for the foreseeable future. We may never achieve or sustain profitability.

We have incurred substantial net losses since our inception. For the years ended December 31, 2011 and 2012 and the nine months ended September 30, 2012 and 2013, we incurred a net loss of $23.8 million, $35.0 million, $10.7 million and $8.9 million, respectively, and used cash in operations of $14.9 million, $9.7 million, $6.4 million and $4.6 million, respectively. We have an accumulated deficit of $131.6 million as of December 31, 2012 and $140.6 million as of September 30, 2013. With the exception of a small net income for the years ended December 31, 2002 and 1999, we have incurred net losses in each year since inception. Our losses have resulted principally from costs incurred in connection with our sales and marketing activities, research and development activities, manufacturing activities, general and administrative expenses associated with our operations, impairments on intangible assets and interest expense. Even if we are successful in launching additional products into the market, we expect to continue to incur substantial losses for the foreseeable future as we continue to sell and market our current products and research and develop, and seek regulatory approvals for, our product candidates.

If sales revenue from any of our current products or product candidates that receive marketing clearance from the FDA or other regulatory body is insufficient, if we are unable to develop and commercialize any of our product candidates, or if our product development is delayed, we may never become profitable. Even if we do become profitable, we may be unable to sustain or increase our profitability on a quarterly or annual basis.

Our success depends on our ability to successfully commercialize silicon nitride-based medical devices, which to date have experienced only limited market acceptance.

We believe we are the first and only company to use silicon nitride in medical applications. To date, however, we have had limited acceptance of our silicon nitride-based products and our product revenue has been derived substantially from our non-silicon nitride products. In order to succeed in our goal of becoming a leading biomaterial technology company utilizing silicon nitride, we must increase market awareness of our silicon nitride interbody spinal fusion products, continue to implement our sales and marketing strategy, enhance our commercial infrastructure and commercialize our silicon nitride joint replacement components and other products. If we fail in any of these endeavors or experience delays in pursuing them, we will not generate revenues as planned and will need to curtail operations or seek additional financing earlier than otherwise anticipated.

Our current products and our future products may not be accepted by hospitals and surgeons and may not become commercially successful.

Although we received 510(k) regulatory clearance from the FDA for our first silicon nitride spinal fusion products in 2008, we have not been able to obtain significant market share of the interbody spinal fusion market to date, and may not obtain such market share in the future. Even if we receive regulatory clearances or approvals for our product candidates in development, these product candidates may not gain market acceptance among orthopedic surgeons and the medical community. Orthopedic surgeons may elect not to use our products for a variety of reasons, including:

| • | lack or perceived lack of evidence supporting the beneficial characteristics of our silicon nitride technology; |

| • | limited long-term data on the use of silicon nitride in medical devices; |

| • | lower than expected clinical benefits in comparison with other products; |

10

| • | surgeons’ perception that there are insufficient advantages of our products relative to currently available products; |

| • | hospitals may choose not to purchase our products; |

| • | group purchasing organizations may choose not to contract for our products, thus limiting availability of our products to hospital purchasers; |

| • | the price of our products, which may be higher than products made of the other commonly used biomaterials in the interbody spinal fusion market and total joint market; |

| • | lack of coverage or adequate payment from managed care plans and other third-party payors for the procedures that use our products; |

| • | Medicare, Medicaid or other third-party payors may limit or not permit reimbursement for procedures using our products; |

| • | ineffective marketing and distribution support; |

| • | the time and resources that may be required for training, or the inadequate training, of surgeons in the proper use of our products; |

| • | the development of alternative biomaterials and products that render our products less competitive or obsolete; and |

| • | the development of or improvement of competitive products. |

If surgeons do not perceive our silicon nitride products and product candidates as superior alternatives to competing products, we will not be able to generate significant revenues, if any.

Even if surgeons are convinced of the superior characteristics of our silicon nitride products and our product candidates that we successfully introduce compared to the limitations of the current commonly used biomaterials, surgeons may find other methods or turn to other biomaterials besides silicon nitride to overcome such limitations. For instance, with respect to interbody spinal fusion products, surgeons or device manufacturers may use more effective markers for enhancing the imaging compatibility of PEEK devices, more effective antibiotics to prevent or treat implant-related infections, and more effective osteoconductive and osteoinductive materials when implanting an interbody spinal fusion device. Device manufacturers may also coat metal with existing traditional ceramics to reduce the risk of metal wear particles and corrosion in total joint replacement implants. Additionally, surgeons may increase their use of metal interbody spinal fusion devices if there is an increasing perception that PEEK devices are limited by their strength and resistance to fracture.

If we are unable to increase the productivity of our sales and marketing infrastructure we will not be able to penetrate the spinal fusion market.

We market and sell our products to surgeons and hospitals in the United States and select markets in Europe and South America using a network of independent third-party distributors who have existing surgeon relationships. We manage this distribution network through our in-house sales and marketing management team. We may also establish distribution collaborations in the United States and abroad in instances where access to a large or well-established sales and marketing organization may help to expand the market or accelerate penetration for selected products.

We cannot assure you that we will succeed in entering into and maintaining productive arrangements with an adequate number of distributors that are sufficiently committed to selling our products. The establishment of a distribution network is expensive and time consuming. As we launch new products and increase our marketing effort with respect to existing products, we will need to continue to hire, train, retain and motivate skilled independent distributors with significant technical knowledge in various areas, such as spinal fusion and total hip and knee joint replacement. In addition, the commissions we pay our distributors have increased over time, which has resulted in higher sales and marketing expenses, and those commissions and expenses may increase in the future. Furthermore, current and potential distributors may market and sell the products of our competitors. Even if the distributors market and sell our products, our competitors may be able, by offering higher commission payments or other incentives, to persuade these distributors to reduce or terminate their sales and marketing efforts related to our products. The distributors may also help competitors solicit business from our existing customers. Some of our independent distributors account for a significant portion of our sales volume, and, if we were to lose them, our sales could be adversely affected.

11

Even if we engage and maintain suitable relationships with an adequate number of distributors, they may not generate revenue as quickly as we expect them to, commit the necessary resources to effectively market and sell our products, or ultimately succeed in selling our products. We have been unable to obtain meaningful market share in the interbody spinal fusion device market with our current silicon nitride products to date and we may not be successful in increasing the productivity of our sales and marketing team and distribution network to gain meaningful market share for our silicon nitride products, which could adversely affect our business and financial condition.

The orthopedic market is highly competitive and we may not be able to compete effectively against the larger, well-established companies that dominate this market or emerging and small innovative companies that may seek to obtain or increase their share of the market.

The markets for spinal fusions and total hip and knee implant products are intensely competitive, and many of our competitors are much larger and have substantially more financial and human resources than we do. Many have long histories and strong reputations within the industry, and a relatively small number of companies dominate these markets. In 2012, Medtronic, Inc.; DePuy Synthes Companies, a group of Johnson & Johnson companies; Stryker Corporation; Biomet, Inc.; Zimmer Holdings, Inc.; and Smith & Nephew plc, accounted for more than 65% of orthopedic sales worldwide.

These companies enjoy significant competitive advantages over us, including:

| • | broad product offerings, which address the needs of orthopedic surgeons and hospitals in a wide range of procedures; |

| • | products that are supported by long-term clinical data; |

| • | greater experience in, and resources for, launching, marketing, distributing and selling products, including strong sales forces and established distribution networks; |

| • | existing relationships with spine and joint reconstruction surgeons; |

| • | extensive intellectual property portfolios and greater resources for patent protection; |

| • | greater financial and other resources for product research and development; |

| • | greater experience in obtaining and maintaining FDA and other regulatory clearances and approvals for products and product enhancements; |

| • | established manufacturing operations and contract manufacturing relationships; |

| • | significantly greater name recognition and widely recognized trademarks; and |

| • | established relationships with healthcare providers and payors. |

Our products and any product candidates that we may introduce into the market may not enable us to overcome the competitive advantages of these large and dominant orthopedic companies. In addition, even if we successfully introduce additional product candidates incorporating our silicon nitride biomaterial into the market, emerging and small innovative companies may seek to increase their market share and they may eventually possess competitive advantages, which could adversely impact our business. Our competitors may also employ pricing strategies that could adversely affect the pricing of our products and pricing in the spinal fusion and total joint replacement market generally.

Moreover, many other companies are seeking to develop new biomaterials and products which may compete effectively against our products in terms of performance and price. For example, Smith & Nephew has developed a ceramic-coated metal, known as Oxinium, that may overcome certain of the limitations of metal joint replacement products and could directly compete with our silicon nitride and silicon nitride coated product candidates.

We have significant customer concentration, so that economic difficulties or changes in the purchasing policies or patterns of our key customers could have a significant impact on our business and operating results.

A small number of customers account for a substantial portion of our product revenues. Our customers are primarily hospitals and surgical centers. At September 30, 2013, our largest customer, Bon Secours St. Mary’s Hospital, or St. Mary’s, had a receivable balance of approximately 11% of our total trade accounts receivable. In addition, St. Mary’s accounted for 17% and 14% of our product revenues for the years ended December 31, 2011

12

and 2012, respectively, and 15% of our product revenues for the nine months ended September 30, 2013. Sales of our products to our customers, including St. Mary’s, are not based on long-term, committed-volume purchase contracts, and we may not continue to receive significant revenues from St. Mary’s or any customer. Because of our significant customer concentration, our revenue could fluctuate significantly due to changes in economic conditions, the use of competitive products, or the loss of, reduction of business with, or less favorable terms with St. Mary’s or any of our other significant customers. A significant portion of St. Mary’s’ purchases have been of our non-silicon nitride products, so it may be able to purchase competitive similar products from others. A reduction or delay in orders from St. Mary’s or any of our other significant customers, or a delay or default in payment by any significant customer, could materially harm our business and results of operations.

The manufacturing process for our silicon nitride products is complex and requires sophisticated state-of-the-art equipment, experienced manufacturing personnel and highly specialized knowledge. If we are unable to manufacture our silicon nitride products on a timely basis consistent with our quality standards, our results of operation will be adversely impacted.

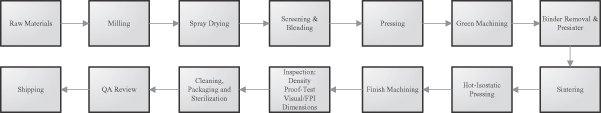

In order to control the quality, cost and availability of our silicon nitride products, we developed our own manufacturing capabilities. We operate a 30,000 square foot manufacturing facility which is certified under the ISO 13485 medical device manufacturing standard for medical devices and operates under the FDA’s quality systems regulations, or QSRs. All operations with the exceptions of raw material production, cleaning, packaging and sterilization are performed at this facility.

We currently do not have a secondary source for the manufacture of our silicon nitride products. Our reliance solely on our internal resources to manufacture our silicon nitride products entails risks to which we would not be subject if we had secondary suppliers for their manufacture, including:

| • | the inability to meet our product specifications and quality requirements consistently; |

| • | a delay or inability to procure or expand sufficient manufacturing capacity to meet additional demand for our products; |

| • | manufacturing and product quality issues related to the scale-up of manufacturing; |

| • | the inability to produce a sufficient supply of our products to meet product demands; |

| • | the disruption of our manufacturing facility due to equipment failure, natural disaster or failure to retain key personnel; and |

| • | our inability to ensure our compliance with regulations and standards of the FDA including QSRs and corresponding state and international regulatory authorities. |

Any of these events could lead to a reduction in our product sales, product launch delays, failure to obtain regulatory clearance or approval or impact our ability to successfully sell our products and commercialize our products candidates. Some of these events could be the basis for adverse actions by regulatory authorities, including injunctions, recalls, seizures, or total or partial suspension of production. In November 2013, we entered into a cooperative research and development agreement with Kyocera Industrial Ceramics Corporation, or Kyocera, under which we will work with Kyocera to determine its ability to become a second qualified manufacturer of our silicon nitride-based spinal fusion products and product candidates. Although we expect this arrangement will lead to Kyocera becoming a secondary qualified manufacturer, if Kyocera fails to become a qualified manufacturer or if we cannot come to an agreement with Kyocera for the further manufacture of our silicon nitride-based spinal fusion products and product candidates, we will continue to be the sole manufacturer of these products and will need to seek other potential secondary manufacturers.

We depend on a limited number of third-party suppliers for key raw materials used in the manufacturing of our silicon nitride products, and the loss of these third-party suppliers or their inability to supply us with adequate raw materials could harm our business.

We rely on a limited number of third-party suppliers for the raw materials required for the production of our silicon nitride products and product candidates. Our dependence on a limited number of third-party suppliers involves several risks, including limited control over pricing, availability, quality, and delivery schedules for raw materials. We have no supply agreements in place with any of our suppliers and cannot be certain that our current suppliers will continue to provide us with the quantities of raw materials that we require or that satisfy our

13

anticipated specifications and quality requirements. Any supply interruption in limited or single sourced raw materials could materially harm our ability to manufacture our products until a new source of supply, if any, could be identified and qualified. We may be unable to find a sufficient alternative supply channel within a reasonable time or on commercially reasonable terms. Any performance failure on the part of our suppliers could delay the production of our silicon nitride products and product candidates and delay the development and commercialization of our product candidates, including limiting supplies necessary for commercial sale, clinical trials and regulatory approvals, which could have a material adverse effect on our business.

Use of third-party manufacturers increases the risk that we will not have adequate supplies of our non-silicon nitride products or instrumentation sets.

The majority of our product revenue is currently generated by sales of non-silicon nitride products. Our reliance on a limited number of third-party manufacturers to supply us with our non-silicon nitride products and instruments exposes us to risks that could delay our sales, or result in higher costs or lost product revenues. In particular, our manufacturers could:

| • | encounter difficulties in achieving volume production, quality control and quality assurance or suffer shortages of qualified personnel, which could result in their inability to manufacture sufficient quantities of our commercially available non-silicon nitride products to meet market demand for those products, or they could experience similar problems that result in the manufacture of insufficient quantities of our non-silicon nitride product candidates; and |

| • | fail to follow and remain in compliance with the FDA-mandated QSRs, compliance which is required for all medical devices, or fail to document their compliance to QSRs, either of which could lead to significant delays in the availability of materials for our non-silicon nitride products or instrumentation sets. |

If we are unable to obtain adequate supplies of our non-silicon nitride products and related instrumentation sets that meet our specifications and quality standards, it will be difficult for us to compete effectively. We have no supply agreements in place with our manufacturers and they may change the terms of our future orders or choose not to supply us with products or instrumentation sets in the future. Furthermore, if a third-party manufacturer from whom we purchase fails to perform its obligations, we may be forced to purchase products or related instrumentation from other third-party manufacturers, which we may not be able to do on reasonable terms, if at all. In addition, if we are required to change manufacturers for any reason, we will be required to verify that the new manufacturer maintains facilities and procedures that comply with quality standards and with all applicable regulations and guidelines. The delays associated with the verification of a new manufacturer or the re-verification of an existing manufacturer could negatively affect our ability to produce and distribute our non-silicon nitride products or instruments in a timely manner.

In order to be successful, we must expand our available product lines of silicon nitride-based medical devices by commercializing new product candidates, but we may not be able to do so in a timely fashion and at expected costs, or at all.

Although we are currently marketing our silicon nitride interbody spinal fusion implants, in order to be successful, we will need to expand our product lines to include other silicon nitride devices. Therefore, we are developing silicon nitride product candidates for total hip and knee replacement procedures and are exploring the application of our silicon nitride technology for other potential applications. However, we have yet to commercialize any silicon nitride products beyond our spinal fusion products. To succeed in our commercialization efforts, we must effectively continue product development and testing, obtain regulatory clearances and approvals, and enhance our sales and marketing capabilities. We may also have to write down significant inventory if existing products are replaced by new products. Because of these uncertainties, there is no assurance that we will succeed in bringing any of our current or future product candidates to market. If we fail in bringing our product candidates to market, or experience delays in doing so, we will not generate revenues as planned and will need to curtail operations or seek additional financing earlier than otherwise anticipated.

14

We will depend on one or more strategic partners to develop and commercialize our total joint replacement product candidates, and if our strategic partners are unable to execute effectively on our agreements with them, we may never become profitable.

Pursuant to a joint development and license agreement with Orthopaedic Synergy, Inc., or OSI, we are dependent on OSI’s ability to execute product development plans, obtain regulatory approvals, and sell, distribute and market our jointly developed product candidate for total hip and total knee joint replacement implants that use our MC2 silicon nitride technology. We would similarly be reliant on other strategic partners to develop and commercialize a total hip or knee joint replacement product candidate that utilizes silicon nitride-coated components, although we have not yet entered into an agreement with any strategic partner to develop products with these silicon nitride-coated components and may be unable to do so on agreeable terms. In order to succeed in our joint commercialization efforts, we and OSI, and any future partners must execute effectively on all elements of a combined business plan, including continuing to establish sales and marketing capabilities, manage certified, validated and effective commercial-scale manufacturing operations, conduct product development and testing, and obtain regulatory clearances and approvals for our product candidate. If we or any of our strategic partners fail in any of these endeavors, or experience delays in pursuing them, we will not generate revenues as planned and will need to curtail operations or seek additional financing earlier than otherwise anticipated.

The use of physician-owned distributorships could result in increased pricing pressure on our products or harm our ability to sell our products to physicians who own or are affiliated with those distributorships and the sale of our products through such distributorships may expose us to regulatory enforcement risk.

Physician-owned distributorships, or PODs, are medical device distributors that are owned, directly or indirectly, by physicians. These physicians derive a proportion of their revenue from selling or arranging for the sale of medical devices for use in procedures they perform on their own patients at hospitals that agree to purchase from or through the POD, or that otherwise furnish ordering physicians with income that is based directly or indirectly on those orders of medical devices.

We may sell and distribute our products through a limited number of PODs. The number of PODs in the orthopedic industry may continue to grow as physicians search for ways to increase their incomes. These companies and the physicians who own, or partially own, them have significant market knowledge and access to the surgeons and hospitals that may potentially purchase our products and the physicians who own these PODs will have financial incentives to purchase from these distributorships. As a result, growth in this area may reduce our ability to compete effectively for business.

On March 26, 2013, the Department of Health and Human Services Office of Inspector General issued a Special Fraud Alert on Physician-Owned Entities and identified PODs as “inherently suspect” under the federal Anti-Kickback Statute. While the PODs themselves may be the target of any government enforcement efforts in this area, it is possible that regulatory scrutiny may extend to other entities that have relationships with PODs, including us. We are not aware that we are currently subject to any such scrutiny. However, the cost of defending such enforcement actions, if brought (even without merit), as well as any sanctions, if imposed, could have a material adverse effect on our business.

If hospitals and other healthcare providers are unable to obtain coverage or adequate reimbursement for procedures performed with our products, it is unlikely our products will be widely used.

In the United States, the commercial success of our existing products and any future products will depend, in part, on the extent to which governmental payors at the federal and state levels, including Medicare and Medicaid, private health insurers and other third-party payors provide coverage for and establish adequate reimbursement levels for procedures utilizing our products. Because we typically receive payment directly from hospitals and surgical centers, we do not anticipate relying directly on payment from third-party payors for our products. However, hospitals and other healthcare providers that purchase our orthopedic products for treatment of their patients generally rely on third-party payors to pay for all or part of the costs and fees associated with our products as part of a “bundled” rate for the associated procedures. The existence of coverage and adequate reimbursement for our products and the procedures performed with them by government and private payors is critical to market acceptance of our existing and future products. Neither hospitals nor surgeons are likely to use our products if they do not receive adequate reimbursement for the procedures utilizing our products.

15

Many private payors currently base their reimbursement policies on the coverage decisions and payment amounts determined by the Centers for Medicare and Medicaid Services, or CMS, which administers the Medicare program. Others may adopt different coverage or reimbursement policies for procedures performed with our products, while some governmental programs, such as Medicaid, have reimbursement policies that vary from state to state, some of which may not pay for the procedures performed with our products in an adequate amount, if at all. A Medicare national or local coverage decision denying coverage for one or more of our products could result in private and other third-party payors also denying coverage for our products. Third-party payors also may deny reimbursement for our products if they determine that a product used in a procedure was not medically necessary, was not used in accordance with cost-effective treatment methods, as determined by the third-party payor, or was used for an unapproved use. Unfavorable coverage or reimbursement decisions by government programs or private payors underscore the uncertainty that our products face in the market and could have a material adverse effect on our business.

Many hospitals and clinics in the United States belong to group purchasing organizations, which typically incentivize their hospital members to make a relatively large proportion of purchases from a limited number of vendors of similar products that have contracted to offer discounted prices. Such contracts often include exceptions for purchasing certain innovative new technologies, however. Accordingly, the commercial success of our products may also depend to some extent on our ability to either negotiate favorable purchase contracts with key group purchasing organizations and/or persuade hospitals and clinics to purchase our product “off contract.”

The healthcare industry in the United States has experienced a trend toward cost containment as government and private payors seek to control healthcare costs by paying service providers lower rates. While it is expected that hospitals will be able to obtain coverage for procedures using our products, the level of payment available to them for such procedures may change over time. State and federal healthcare programs, such as Medicare and Medicaid, closely regulate provider payment levels and have sought to contain, and sometimes reduce, payment levels. Private payors frequently follow government payment policies and are likewise interested in controlling increases in the cost of medical care. In addition, some payors are adopting pay-for-performance programs that differentiate payments to healthcare providers based on the achievement of documented quality-of-care metrics, cost efficiencies, or patient outcomes. These programs are intended to provide incentives to providers to deliver the same or better results while consuming fewer resources. As a result of these programs, and related payor efforts to reduce payment levels, hospitals and other providers are seeking ways to reduce their costs, including the amounts they pay to medical device manufacturers. We may not be able to sell our implants profitably if third-party payors deny or discontinue coverage or reduce their levels of payment below that which we project, or if our production costs increase at a greater rate than payment levels. Adverse changes in payment rates by payors to hospitals could adversely impact our ability to market and sell our products and negatively affect our financial performance.

In international markets, medical device regulatory requirements and healthcare payment systems vary significantly from country to country, and many countries have instituted price ceilings on specific product lines. We cannot assure you that our products will be considered cost-effective by international third-party payors, that reimbursement will be available or, if available, that the third-party payors’ reimbursement policies will not adversely affect our ability to sell our products profitably. Any failure to receive regulatory or reimbursement approvals would negatively impact market acceptance of our products in any international markets in which those approvals are sought.

Prolonged negative economic conditions in domestic and international markets may adversely affect us, our suppliers, partners and consumers, and the global orthopedic market which could harm our financial position.

Global credit and financial markets have been experiencing extreme disruptions over the past several years, including severely diminished liquidity and availability of credit, declines in consumer confidence, declines in economic growth, increases in unemployment rates and uncertainty about economic stability. Credit and financial markets and confidence in economic conditions might deteriorate further. Our business may be adversely affected by the recent economic downturn and volatile business environment and continued unpredictable and unstable market conditions. In addition, there is a risk that one or more of our current suppliers may not continue to operate. Any lender that is obligated to provide funding to us under any future credit agreement with us may not be able to provide funding in a timely manner, or at all, when we require it. The cost of, or lack of, available credit or equity financing could impact our ability to develop sufficient liquidity to

16

maintain or grow our company. These negative changes in domestic and international economic conditions or additional disruptions of either or both of the financial and credit markets may also affect third-party payors and may have a material adverse effect on our business, results of operations, financial condition and liquidity.

In addition, we believe that various demographics and industry-specific trends will help drive growth in the orthopedics markets, but these demographics and trends are uncertain. Actual demand for orthopedic products generally, and our products in particular, could be significantly less than expected if our assumptions regarding these factors prove to be incorrect or do not materialize, or if alternative treatments gain widespread acceptance.

We have a new senior management team and are dependent on our senior management team, engineering team, sales and marketing team and surgeon advisors, and the loss of any of them could harm our business.

We have recently assembled a new senior management team. They have worked together in their new positions with us for a limited time and may not be able to successfully implement our strategy. In addition, we have not entered into employment agreements, other than severance agreements, with any of the members of our senior management team. There are no assurances that the services of any of these individuals will be available to us for any specified period of time. The successful integration of our new senior management team, the loss of members of our senior management team, sales and marketing team, engineering team and key surgeon advisors, or our inability to attract or retain other qualified personnel or advisors could have a material adverse effect on our business, financial condition and results of operations.

If we experience significant disruptions in our information technology systems, our business, results of operations and financial condition could be adversely affected.

The efficient operation of our business depends on our information technology systems. We rely on our information technology systems to effectively manage our sales and marketing, accounting and financial functions; manufacturing processes; inventory; engineering and product development functions; and our research and development functions. As such, our information technology systems are vulnerable to damage or interruption including from earthquakes, fires, floods and other natural disasters; terrorist attacks and attacks by computer viruses or hackers; power losses; and computer systems, or Internet, telecommunications or data network failures. The failure of our information technology systems to perform as we anticipate or our failure to effectively implement new systems could disrupt our entire operation and could result in decreased sales, increased overhead costs, excess inventory and product shortages, all of which could have a material adverse effect on our reputation, business, results of operations and financial condition.

Risks Related to Our Capital Resources and Impairments