As filed with the Securities and Exchange Commission on May 22, 2007

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AMEDICA CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 3841 | 84-1375299 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

615 Arapeen Drive

Suite 302

Salt Lake City, Utah 84108

(801) 583-5100

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Ashok C. Khandkar, Ph.D.

Chief Executive Officer

Amedica Corporation

615 Arapeen Drive

Suite 302

Salt Lake City, Utah 84108

(801) 583-5100

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

With copies to:

| Jonathan L. Kravetz, Esq. Anthony E. Hubbard, Esq. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. One Financial Center Boston, MA 02111 (617) 542-6000 |

Bruce K. Dallas, Esq. Davis Polk & Wardwell 1600 El Camino Real Menlo Park, CA 94025 (650) 752-2000 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Offering Price(1) |

Amount of Registration Fee(1) | ||||||

| Common Stock, $0.01 par value per share |

$ | 74,750,000 | $ | 2,294.83 | ||||

| (1) | Estimated solely for the purpose of calculating the amount of registration fee pursuant to Rule 457(o) under the Securities Act, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The Information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities, and we are not soliciting offers to buy these securities, in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued May 22, 2007

Shares

COMMON STOCK

Amedica Corporation is offering shares of its common stock. This is our initial public offering and no public market currently exists for our shares. We anticipate that the initial public offering price will be between $ and $ per share.

We have applied to have our common stock approved for listing on The NASDAQ Global Market under the symbol “AMCA.”

Investing in our common stock involves risks. See “ Risk Factors” beginning on page 9.

PRICE $ A SHARE

| Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Amedica | ||||

| Per Share |

$ | $ | $ | |||

| Total |

$ | $ | $ |

We have granted the underwriters the right to purchase up to an additional shares of common stock to cover over-allotments.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2007.

| MORGAN STANLEY |

| JEFFERIES & COMPANY |

| CIBC WORLD MARKETS |

, 2007

You should rely only on the information contained in this prospectus or contained in any free writing prospectus that we may authorize to be delivered to you. We have not, and the underwriters have not, authorized any other person to provide you with information different from, or in addition to, that contained in this prospectus or any related free writing prospectus. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus or any related free writing prospectus is accurate only as of its date, regardless of the time of its delivery, or of any sale of common stock.

Through and including , 2007 (25 days after the date of this prospectus), all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

This summary highlights what we believe are the most important features of this offering and the information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully, including “Risk Factors” and our financial statements and the related notes included in this prospectus. Unless the context requires otherwise, references to “Amedica,” “we,” “our” and “us” in this prospectus refer to Amedica Corporation.

AMEDICA CORPORATION

Overview

We are an orthopedic implants company focused on using our silicon nitride ceramic technologies to develop, manufacture and commercialize a broad range of advanced, high-performance spine and joint implants. We have developed a formulation of silicon nitride which we believe has the strength, toughness and wear resistance necessary to overcome the limitations of currently available orthopedic implants. Upon introduction to market, our implants will represent the first commercial use of silicon nitride ceramics in orthopedic applications and will have the potential to provide an improved combination of characteristics, including substantially greater strength and resistance to fracture, superior resistance to wear, greater ability to promote bone attachment, and better compatibility with surgical and diagnostic imaging. Based on these potential advantages, we believe that our silicon nitride product candidates will achieve better long-term clinical outcomes due to their enhanced durability, longevity, biocompatibility and patient fit. As a result, we intend to establish our silicon nitride implants as new standards of care for the largest and fastest growing orthopedic implant markets: the spine, hip and knee markets.

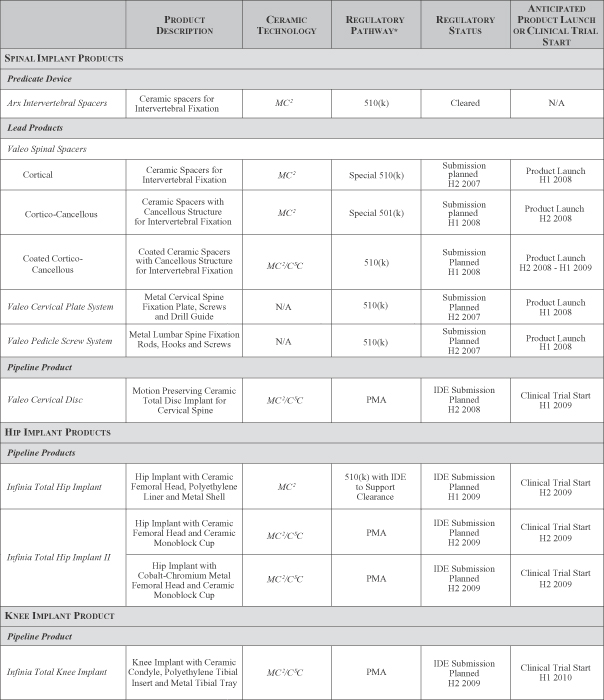

Our lead product candidates under development are our ValeoTM family of spinal implants, which will be used to restore and maintain the alignment of vertebrae in the cervical, or neck region, and lumbar, or lower back region, of the spine. We expect to launch these product candidates by mid-2008, subject to clearance by the U.S. Food and Drug Administration, or the FDA. In 2006, we received clearance from the FDA for the first ever ceramic spinal spacer for insertion between two vertebrae to help stabilize the spine, which will be the predicate device for the first of our product candidates that we intend to commercialize. We plan to introduce additional spinal spacers by the end of 2008, subject to regulatory clearance, including cortico-cancellous spacers that feature a bone-like structure with a solid, or cortical, load-bearing portion and a cancellous, or porous, structure that is intended to promote bone attachment for secure spinal fixation. Subsequently, subject to regulatory approval, we plan to introduce cortico-cancellous spinal spacers with a surface coating designed to further enhance bone attachment. Our Valeo family of spinal implant candidates also includes an all-ceramic, motion-preserving cervical disc, for which we anticipate commencing a clinical trial by mid-2009. In addition, we are incorporating our silicon nitride ceramic technology into the development of our InfiniaTM family of total hip and knee implants. We anticipate commencing a clinical trial for our first total hip implant product candidate in 2009.

During the past two years, we have been developing our own manufacturing facility and processes that will provide us the ability to control the commercial-scale production of our silicon nitride ceramic implants from powder form to devices ready for sterilization and packaging. We are currently producing our lead ceramic spinal product candidates on a pilot scale in our manufacturing facility. We anticipate our facility will be fully operational for commercial-scale production by the end of 2007, which we believe would make us the only vertically integrated silicon nitride orthopedic implant manufacturer in the world.

1

Our Market Opportunity

According to the Millennium Research Group, approximately 1.5 million patients undergo spine, hip and knee surgery involving the use of implants each year in the United States, and this number is expected to grow primarily due to the rising incidence of arthritis. In 2005, an estimated 46 million U.S. adults suffered from doctor-diagnosed arthritis, and nearly two-thirds of those afflicted were younger than age 65. Osteo-arthritis, a condition involving the degeneration, or wearing away, of the cartilage at the end of bones, is a common form of arthritis, and often results in progressive joint disease and pain. The prescribed treatment for osteo-arthritis disorders depends on the severity and duration of the disorder and ranges from non-operative procedures including bed rest, medication, lifestyle modifications, exercise, physical therapy, chiropractic care and steroid injections, to surgical intervention including total joint replacement. In cases where surgical intervention is prescribed, the use of implants has evolved into the standard of care in spine, hip and knee surgery.

The spine market is the fastest growing market for orthopedic implants, accounting for $3.3 billion in sales in the United States in 2006, and is projected to grow at an average annual rate of 12.0% through 2011 to approximately $5.9 billion. Spinal fixation surgeries currently represent the vast majority of procedures in this market. Approximately 500,000 spinal fixation surgery procedures were performed in the United States in 2006, accounting for approximately $3.2 billion of the total $3.3 billion in U.S. spine implant market.

Orthopedic implants used in hip and knee replacement surgeries generated approximately $5.6 billion in sales in 2006 in the United States, and such sales are projected to increase at an average annual rate of 9.4% through 2011 to approximately $8.8 billion. Approximately one million primary hip and knee replacement procedures were performed in the United States in 2006.

We believe that the market for implants used in spine, hip and knee surgical procedures will continue to grow because of the following market dynamics:

| • | growth of the aging population; |

| • | changing lifestyle expectations; |

| • | earlier surgical intervention; |

| • | rising number of revision surgeries; |

| • | introduction of new technologies; and |

| • | market expansion into new geographic areas. |

Our Solution

We believe our silicon nitride ceramic technologies, MC2 and CSC, will overcome many of the limitations associated with currently available implant materials by providing an improved combination of characteristics, including:

| • | substantially greater strength and resistance to fracture than currently marketed ceramic implants; |

| • | superior resistance to wear compared to implants made of plastics and metals; |

| • | greater ability to promote bone attachment than traditional plastic and metal implants such as polyetheretherketone, or PEEK, and titanium; and |

| • | better compatibility with surgical and diagnostic imaging techniques. |

We believe that the anticipated greater strength and fracture resistance of our silicon nitride implant candidates will allow us to offer a wider range of design and size options along with substantially reduced risk of

2

fracture compared to currently marketed implants made of ceramic materials. We further believe that the anticipated superior wear resistance and the improved biocompatibility over the life of our silicon nitride product candidates will reduce the risk of bone loss and allergic response to metal wear particles. Based on these potential advantages, we believe that our silicon nitride product candidates will achieve better long-term clinical outcomes with a combination of improved durability, longevity, biocompatibility and patient fit. Our ceramic product categories include:

| • |

Micro-Composite Ceramic, or MC2. We refer to our formulation of silicon nitride as MC2, or Micro-Composite Ceramic. We expect that all of our ceramic product candidates will be made using our MC2 silicon nitride. |

| • |

Cortico-cancellous Structured Ceramics, or CSC. We also are developing silicon nitride ceramic implants that mimic the structure of natural bone by incorporating both a dense load-bearing component and a porous component, coupled with a surface coating, to promote bone attachment. We call our ceramic implants based on this technology CSC, or Cortico-cancellous Structured Ceramic, implants. |

Our Strategy

Our goal is to become a leading orthopedic company offering advanced silicon nitride ceramic implants for a broad range of orthopedic indications. We intend to use our ceramic technologies to develop implants that have significant performance advantages compared to existing implants. We believe that the combined benefits of our MC2 and CSC technologies will give our product candidates the potential to become a new standard of care for spine, hip and knee procedures.

Key elements of our strategy to achieve this objective include the following:

| • | launch near-term product candidates that address substantial market opportunities and build market awareness; |

| • | build a broad portfolio of ceramic implants targeting expanded indications and additional surgical procedures; |

| • | leverage the expertise of our surgeon advisors to design physician-preferred product features and to drive market awareness; |

| • | establish a hybrid sales organization utilizing experienced, independent sales agencies and a direct sales force; and |

| • | selectively establish collaborations for our implants with leading orthopedic companies. |

Our Product Candidates

We are using our MC2 and CSC ceramic technologies to develop and commercialize innovative orthopedic implant products for the spine, hip and knee implant markets.

Our Spinal Implant Products

We have designed our lead product candidates in our Valeo family of spinal implants as a complete solution for surgical procedures for spinal fixation. These products, if cleared or approved by the FDA, include spinal spacers, a cervical bone plate system, a pedicle screw system, and a set of surgical instruments that facilitate the placement of our implants in the body. We are also developing an all-ceramic motion-preserving cervical disc.

Valeo Cortical and CSC Spinal Spacers. We have designed our Valeo family of spinal spacers, using silicon nitride ceramic, as intervertebral fixation implants for stabilizing the spine that replace a portion of a vertebra

3

that has collapsed, been damaged, or becomes unstable due to disease or trauma. We believe that each of our Valeo Spinal Spacers will have significant competitive advantages compared to existing spinal implants. We developed and received FDA clearance for our ArxTM Intervertebral Spacers made from MC2 silicon nitride, which will serve as the predicate device for the 510(k) premarket notification for our Valeo Cortical Spinal Spacers product candidate.

Valeo Cervical Plate System and Pedicle Screw System. We are developing our Valeo Cervical Plate System and Valeo Pedicle Screw System as titanium alloy supplemental fixation implants to be used in conjunction with our Valeo Spinal Spacers. Our design and instruments combine special features to enable surgeons, in a single step, to hold the cervical plate in place, ensure proper angling and insertion of the screws into the vertebrae, and achieve a consistent supplemental fixation outcome. Our screw system incorporates modularity in the system components to permit such flexibility, which we believe will provide better clinical outcomes.

Valeo Cervical Disc. We are developing our Valeo Cervical Disc, using both our MC2 and CSC technologies, as a silicon nitride ceramic implant to meet the unmet market need for a disc replacement implant that will restore natural motion and provide uncompromised wear resistance and favorable imaging characteristics in the cervical spine. We believe our Valeo Cervical Disc will represent a significant advance over currently available disc implants.

Our Hip Implant Products

Infinia Total Hip Implant. We are developing our Infinia Total Hip Implant for patients undergoing total hip replacement surgery for the treatment of degenerative joint disease. In our first hip replacement implant, we will use silicon nitride ceramic for the femoral head component of this implant. The counter-bearing, or mating component, of the hip implant, will be a polyethylene liner, fixed into a metal acetabular cup, using industry-recognized designs and materials. We anticipate that our Infinia Total Hip Implant, if cleared by the FDA based on clinical trial results, will provide significant competitive advantages over traditional total hip replacement implants presently on the market.

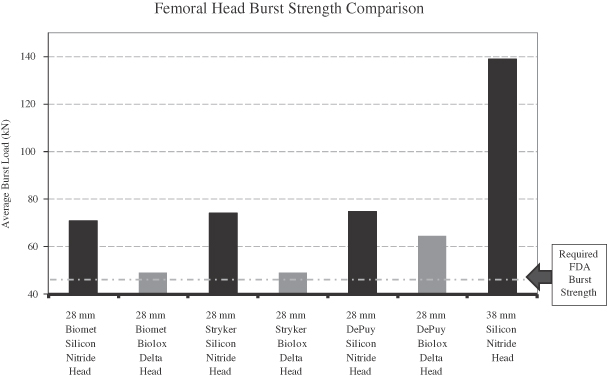

Infinia Total Hip Implant II. We are developing our second generation Infinia Total Hip Implant II which, if approved by the FDA, will feature our Infinia monoblock cup, an industry-first, one-piece, fully ceramic acetabular cup, our large diameter Infinia ceramic and metal femoral heads, and our Infinia femoral stem. The Infinia monoblock cup will be made from silicon nitride ceramic and will incorporate a smooth bearing surface on the inside of the cup integrated with a bone attachment surface incorporating our CSC technology on the outside of the cup that comes into contact with a patient’s pelvis. The femoral head of the implant will be a large-diameter head offered in two versions, one made of silicon nitride and the other of cobalt-chromium metal alloy. The femoral head will be used with a metal stem inserted into the femur. In contrast to currently marketed ceramic femoral heads, we are designing our MC2 femoral head to offer surgeons a range of size and design options comparable to those available in metal femoral heads.

Our Knee Implant Product

Infinia Total Knee Implant. Our Infinia Total Knee Implant will incorporate silicon nitride bearing components for the femoral condyle. The tibial tray will be made from traditional metal. The tibial insert will be made from polyethylene in a rotating platform design intended to give the knee implant a range of motion and flexion similar to the natural knee. We anticipate that this total knee replacement product candidate, if approved by the FDA, will provide natural anatomic motion and will offer a low-wear knee replacement option, providing significantly improved longevity compared with current metal-on-polyethylene knee implants.

4

Risks Associated with Our Business

Our business is subject to a number of risks that you should be aware of before making an investment decision. These risks are discussed more fully in the section of this prospectus entitled “Risk Factors.” We have not received regulatory clearance or approval to commercialize our Valeo or Infinia product candidates for any intended use. If we are unable to successfully develop, receive regulatory clearance for and commercialize our implant products, we may never generate revenue or be profitable and may have to cease operations. We have a limited operating history and no products in commercial distribution. To date, our only significant revenue has been from research grants from the National Institutes of Health and with the exception of a small net income for the years ended December 31, 2002 and 1999, we have incurred net losses in each year since our inception. Our ability to expand the use of our ceramic technologies may be limited by a number of factors, including intellectual property held by other parties. Our competitors and potential competitors include much larger companies with more resources and commercialization experience than we have. We have generated no revenues from operations, and as of March 31, 2007, we had an accumulated deficit during the development stage of $18.2 million. We expect to continue to incur additional, and possibly increasing, losses through at least the end of 2010.

Corporate Information

We were incorporated in Delaware in 1996 under the name Amedica Corp. and have since changed our name to Amedica Corporation. Our principal executive offices are located at 615 Arapeen Drive, Suite 302, Salt Lake City, Utah 84108, and our telephone number is (801) 583-5100. Our web site address is www.amedicacorp.com. The information on, or that may be accessed through, our web site is not incorporated by reference into this prospectus and should not be considered a part of this prospectus. As used in this prospectus, references to “we,” “our,” “us” and “Amedica” refer to Amedica Corporation unless the context requires otherwise.

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

We have applied for federal registration of the marks “Altia”, “AMCA”, “Amedica”, “CSC”, “Improving Function. Enhancing Lives.”, “Infinia”, “Infinite Possibility”, “MC2”, and “Valeo”. All other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

5

THE OFFERING

| Common stock offered by us |

shares |

| Common stock to be outstanding after this offering |

shares |

| Over-allotment option |

shares |

| Use of proceeds |

We intend to use the net proceeds from this offering to fund the development and commercialization of our lead products, build our sales, marketing and distribution capabilities, establish commercial-scale manufacturing operations, fund research and development activities for our pipeline products and for other general corporate purposes. See “Use of Proceeds.” |

| Proposed NASDAQ Global Market symbol |

AMCA |

The information above is based on 8,678,995 shares of common stock outstanding as of May 1, 2007, and assumes the conversion of all of our preferred stock outstanding as of May 1, 2007, into 31,856,558 shares of common stock upon the completion of this offering. It does not include:

| • | 3,457,627 shares of common stock issuable upon the exercise of outstanding options to purchase common stock, at a weighted average exercise price of $0.40 per share; |

| • | 4,057,040 shares of common stock issuable upon the exercise of warrants for shares of Series A, Series B, Series C and Series D convertible preferred stock, on an as-converted basis, outstanding as of May 1, 2007, at a weighted average exercise price of $1.36 per share; and |

| • | 857,163 additional shares of common stock reserved for issuance under our 2003 Stock Option Plan. |

Unless otherwise indicated, all information contained in this prospectus:

| • | assumes that the underwriters do not exercise their over-allotment option; |

| • | reflects a one-for- reverse split of our common stock to be effected immediately prior to the completion of this offering; |

| • | reflects the automatic conversion of all of our outstanding shares of preferred stock into 31,856,558 shares of common stock upon completion of this offering; and |

| • | assumes the adoption of our amended and restated certificate of incorporation and amended and restated bylaws upon the completion of this offering. |

6

SUMMARY FINANCIAL DATA

The summary financial data set forth below should be read in conjunction with our financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

| Years Ended December 31, | Three Months Ended March 31, |

Period

from March 31, 2007 |

||||||||||||||||||||||||||||||

| 2002 | 2003 | 2004 | 2005 | 2006 | 2006 | 2007 | ||||||||||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||||||||||

| Grant revenue |

$ | 304,333 | $ | 299,583 | $ | 208,252 | $ | 69,207 | $ | 94,850 | $ | — | $ | — | $ | 1,234,476 | ||||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||||||||||

| Research and development |

207,298 | 380,771 | 1,419,293 | 2,966,991 | 4,974,380 | 1,100,125 | 1,479,340 | 11,802,694 | ||||||||||||||||||||||||

| General and administrative |

67,551 | 142,377 | 398,208 | 576,295 | 1,113,500 | 184,425 | 405,380 | 2,806,322 | ||||||||||||||||||||||||

| Sales and marketing |

— | — | — | 416,847 | 607,538 | 111,038 | 125,740 | 1,150,125 | ||||||||||||||||||||||||

| Total operating expenses |

274,849 | 523,148 | 1,817,501 | 3,960,133 | 6,695,418 | 1,395,588 | 2,010,460 | 15,759,141 | ||||||||||||||||||||||||

| Income (loss) from operations |

29,484 | (223,565 | ) | (1,609,249 | ) | (3,890,926 | ) | (6,600,568 | ) | (1,395,588 | ) | (2,010,460 | ) | (14,524,665 | ) | |||||||||||||||||

| Interest income (expense), net |

(16,705 | ) | (6,863 | ) | 107,211 | 248,838 | 727,939 | 150,487 | 129,148 | 1,153,775 | ||||||||||||||||||||||

| Change in value of preferred stock warrants |

— | — | (254,089 | ) | (577,000 | ) | (290,925 | ) | (72,731 | ) | (3,681,413 | ) | (4,803,427 | ) | ||||||||||||||||||

| Net income (loss) |

$ | 12,779 | $ | (230,428 | ) | $ | (1,756,127 | ) | $ | (4,219,088 | ) | $ | (6,163,554 | ) | $ | (1,317,832 | ) | $ | (5,562,725 | ) | $ | (18,174,317 | ) | |||||||||

| Basic and diluted loss per share |

$ | 0.00 | $ | (0.03 | ) | $ | (0.20 | ) | $ | (0.49 | ) | $ | (0.71 | ) | $ | (0.15 | ) | $ | (0.64 | ) | ||||||||||||

| Weighted average number of shares outstanding—basic and diluted |

8,000,000 | 8,110,933 | 8,585,873 | 8,612,014 | 8,661,713 | 8,655,595 | 8,678,995 | |||||||||||||||||||||||||

| As of March 31, 2007 | |||||||||

| (unaudited) | |||||||||

| Actual | Pro Forma(1) | Pro Forma as Adjusted(1)(2) | |||||||

| Balance Sheet Data: |

|||||||||

| Cash, cash equivalents and marketable securities |

$ | 10,325,322 | $ | 22,725,322 | |||||

| Working capital |

9,541,106 | 21,941,106 | |||||||

| Total assets |

17,207,969 | 29,607,969 | |||||||

| Long-term debt, including current portion |

1,556,241 | 1,556,241 | |||||||

| Convertible preferred stock |

26,389,982 | — | |||||||

| Total stockholders’ equity (deficit) |

(17,559,966 | ) | 27,534,979 | ||||||

| (1) | The pro forma balance sheet data above reflect our unaudited capitalization as of March 31, 2007, on a pro forma basis giving effect to (i) the issuance of 4,456,500 shares of our Series D convertible preferred stock in April 2007 for net proceeds of approximately $12.4 million, (ii) the automatic conversion of all outstanding shares of our convertible preferred stock, including our Series D convertible preferred stock into an aggregate of 31,856,558 shares of our common stock upon the completion of this offering, and (iii) the conversion of warrants to purchase 4,057,040 shares of our convertible preferred stock into warrants to purchase an equal number of shares of our common stock (but not assuming the exercise of these common stock warrants), including warrants to purchase a total of 253,290 shares of Series D convertible preferred stock issued in April 2007 and the related reclassification of the preferred stock warrant liability to additional paid in capital. |

| (2) | The pro forma as adjusted balance sheet data above reflect the issuance of shares of common stock upon the completion of this offering at an assumed initial public offering price of $ per share, the midpoint of the range on the front cover of this prospectus. |

The common share information above does not include:

| • | 3,457,627 shares of common stock issuable upon the exercise of options to purchase common stock, at a weighted average exercise price of $0.40 per share outstanding as of March 31, 2007; |

7

| • | 4,057,040 shares of common stock issuable upon the exercise of warrants for shares of Series A, Series B, Series C and Series D convertible preferred stock, on an as-converted basis, outstanding as of May 1, 2007, at a weighted average exercise price of $1.36 per share; and |

| • | 857,163 additional shares of common stock reserved for issuance under our 2003 Stock Option Plan. |

8

An investment in our common stock involves a high degree of risk. You should carefully read and consider the risks described below, as well as the other information in this prospectus, including our financial statements and the related notes, before deciding to invest in our common stock. If any of the following risks occur, our business, financial condition, results of operations or cash flows could be materially harmed. In that case, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Business and Strategy

We are an early stage company with no product revenues, and if we fail to execute effectively on all elements of our business plan, we may not succeed in our goal of becoming a profitable orthopedic implants company.

We have not yet commercialized any products, we do not expect to introduce any of our lead product candidates until 2008 and we do not anticipate introducing one of our lead spinal spacer product candidates until the second half of 2008. We do not expect to start clinical trials of the earliest of our pipeline products before the first half of 2009. There is no assurance that we will succeed in bringing any of our product candidates to market. In order to succeed in our commercialization efforts, we must execute effectively on all elements of our business plan, including product development and testing, obtaining regulatory clearances and approvals, establishing our sales and marketing capabilities, and developing certified, validated and effective commercial-scale manufacturing operations. If we fail in any of these endeavors, or experience delays in pursuing them, we will not generate revenues as planned and will need to curtail operations or seek additional financing earlier than otherwise anticipated.

Our near-term success depends substantially on our ability to obtain regulatory clearance or approval and thereafter commercialize our most advanced spinal implant product candidates; we cannot be certain that we will be able to do so in a timely fashion or at all.

The process of obtaining regulatory clearances or approvals to market a medical device from the U.S. Food and Drug Administration, or the FDA, or similar regulatory authorities outside of the United States can be costly and time consuming, and there can be no assurance that such clearances or approvals will be granted on a timely basis, or at all. The FDA’s 510(k) clearance process generally takes one to six months from submission, depending on whether a Special or traditional 510(k) premarket notification has been submitted, but can take significantly longer. An application for premarket approval, or PMA, must be submitted to the FDA if the device cannot be cleared through the 510(k) clearance process or is not exempt from premarket review by the FDA. The PMA process almost always requires one or more clinical trials and can take two to three years from the date of filing, or even longer. In some cases, including in the case of our Inifinia Total Hip Implant, the FDA has indicated that it will require clinical data as part of the 510(k) process.

Our regulatory strategy is to try to accelerate market introduction of our most advanced product candidates by submitting either a traditional or a Special 510(k). We currently intend to seek Special 510(k) clearance for certain of our lead spinal implant products under development. We expect to submit a 510(k) for our Infinia Total Hip Implant, which will include our ceramic femoral head, and we anticipate that the FDA will require clinical trials in support of this 510(k) as well as for our applications through the PMA process for the rest of our pipeline product candidates.

There is no certainty, however, that any of our lead product candidates, particularly those incorporating silicon nitride ceramic materials, will be cleared by the FDA by means of either a traditional or a Special 510(k). In correspondence relating to a 510(k) we submitted for spinal product candidates we were developing using zirconia-toughened alumina, the FDA raised a number of questions that are potentially applicable to several of our current spinal product candidates, including our lead product candidates incorporating silicon nitride ceramic materials, and which could result in our having to perform additional studies. While we believe that our current product candidates incorporating silicon nitride ceramic materials differ significantly from our previous product

9

candidates employing zirconia-toughened alumina, we cannot assure you that the FDA will not raise similar questions regarding our current spinal product candidates. If the FDA takes a similar position regarding our product candidates incorporating silicon nitride ceramic materials, our ability to bring our lead products to market could be delayed and we can give no assurance that we would ultimately receive marketing approval.

Even if the FDA permits us to use the 510(k) clearance process, we cannot assure you that the FDA will not require either supporting data from laboratory tests or studies that we have not conducted, or substantial supporting clinical data. If we are unable to use the 510(k) clearance process for any of our lead product candidates, are required to provide clinical data or laboratory data that we do not possess to support our 510(k) premarket notifications for any of these product candidates, or otherwise experience delays in obtaining or fail to obtain regulatory clearances, the commercialization of our most advanced product candidates will be delayed or prevented, which will adversely affect our ability to generate revenues. It also may result in the loss of potential competitive advantages that we might otherwise attain by bringing our products to market earlier than our competitors. Any of these contingencies could adversely affect our business.

Even if we succeed in obtaining FDA clearance or approvals for our lead product candidates and pipeline product candidates within the time frames we anticipate, our products may not be commercially successful.

Even if we receive regulatory clearances or approvals for our lead product candidates and pipeline product candidates, our product candidates may not gain market acceptance among orthopedic surgeons and the medical community. Orthopedic surgeons may elect not to use our products for a variety of reasons, including:

| • | lower than expected clinical benefits in comparison with other implant products; |

| • | surgeons’ perception that there are insufficient advantages of our implants relative to currently available implant products; |

| • | lack of coverage or adequate payment from managed care plans and other third-party payors for the procedures that use our products; |

| • | ineffective marketing and distribution support; |

| • | inadequate training of surgeons in the proper use of our products; |

| • | the development of alternative implant materials and products that render our products less competitive or obsolete; and |

| • | timing of the introduction of competitive products to market. |

If orthopedic surgeons do not perceive our implant products as attractive alternatives to existing products, we will not be able to generate significant revenues, if any.

The orthopedic implant market is highly competitive and we may not be able to compete effectively against the larger, well-established companies that dominate this market or emerging and small innovative companies that may seek to obtain or increase their share of the market.

The markets for spine, hip and knee implant products are intensely competitive, and many of our competitors are much larger and have substantially more financial and human resources than we do. Many have long histories and strong reputations within the industry, and a relatively small number of companies dominate these markets. For example, in 2006, Medtronic Spinal and Biologics, a subsidiary of Medtronic, Inc.; Synthes, Inc.; DePuy Spine, Inc., a subsidiary of Johnson & Johnson; Stryker Spine, a division of Stryker Corporation; Biomet Spine and Biomet Trauma, a subsidiary of Biomet, Inc.; and Zimmer Spine, a subsidiary of Zimmer Holdings, Inc., accounted for over 80% of spine implant sales worldwide. In the hip and knee implant market, Zimmer Holdings, Inc.; DePuy Orthopaedics, Inc., a subsidiary of Johnson & Johnson; Stryker Orthopaedics, a division of Stryker Corporation; Biomet, Inc.; and Smith & Nephew Orthopaedics, a subsidiary of Smith & Nephew plc, accounted for over 80% of sales worldwide.

10

These companies enjoy significant competitive advantages over us, including:

| • | broad implant product offerings, which address the needs of orthopedic surgeons and hospitals in a wide range of implant procedures; |

| • | greater experience in, and resources for, launching, marketing, distributing and selling products, including strong sales forces and established distribution networks; |

| • | existing relationships with spine and joint reconstruction surgeons; |

| • | more extensive intellectual property portfolios and resources for patent protection; |

| • | greater financial and other resources for product research and development; |

| • | greater experience in obtaining and maintaining FDA and other regulatory clearances or approvals for products and product enhancements; |

| • | established manufacturing operations and contract manufacturing relationships; |

| • | significantly greater name recognition and more recognizable trademarks; and |

| • | established relationships with healthcare providers and payors. |

Even if we successfully introduce implant products to market based on our ceramic materials, we may not succeed in overcoming the competitive advantages of these large and dominant orthopedic implant companies. In addition, emerging and small innovative companies may seek to increase their market share and they may later possess competitive advantages, which could also impact our business even if we successfully introduce implant products based on our ceramic materials. Moreover, many other companies are seeking to develop ceramic-based implant products, and these companies may introduce products which compete effectively against our products in terms of performance, price or both.

If we are unable to establish a sales and marketing infrastructure and enter into suitable arrangements with independent sales agencies, we will not be able to commercialize our product candidates.

Upon FDA clearance, we intend to market and sell our lead spinal products in the United States using a hybrid distribution network that includes a combination of experienced, independent sales agents with strong, existing surgeon relationships and a direct sales force in selected markets. A similar hybrid sales force will also be used to market our hip and knee reconstructive products. We have not yet established an internal sales organization, and we will need to recruit and train sales and marketing personnel in time for the launch of our most advanced product candidates, as well as expand our marketing capabilities as we grow our business. The establishment of our sales force will be expensive and time consuming, and we cannot assure you that we will be able to recruit and train a sufficient number of experienced and effective sales personnel on a timely basis.

In addition, we cannot assure you that we will succeed in entering into productive arrangements with an adequate number of sales agencies that are sufficiently dedicated to selling our products. The establishment of a network of sales agencies is expensive and time consuming. Furthermore, many potential sales agencies will market and sell the products of our competitors. Even if these sales agencies agree to market and sell our products, our competitors may be able, by offering higher commission payments or other incentives, to persuade these sales agencies to reduce or terminate their sales and marketing efforts of our products. Even if we enter into agreements with independent sales agencies, they may not generate revenue as quickly as we expect them to, commit the necessary resources to effectively market and sell our products, or ultimately succeed in selling our products. If we are not successful in building an effective external sales and marketing network to complement our internal sales force, we will have difficulty commercializing our product candidates, which would adversely affect our business and financial condition.

11

We are in the process of establishing our own certified manufacturing facility and validating of our manufacturing processes to produce our silicon nitride-based implant products, and we may not be successful in developing the necessary commercial-scale manufacturing processes, facilities and capabilities.

Prior to March 2006, we utilized an internal pilot manufacturing facility to produce prototypes of some of our ceramic product candidates, and we used third parties to produce components of some of our other ceramic product candidates, such as silicon nitride ball blanks for femoral heads. We are currently in the process of developing internal manufacturing operations, and we will need to continue our efforts to develop scaled-up processes, equip our facility and recruit and train manufacturing personnel before the commercial launch of our lead implant products. We anticipate our facility becoming fully operational for commercial-scale production by the end of 2007. Although we have received an International Standards Organization, or ISO, certification for our facility from the British Standards Institution, our facilities are yet to be inspected by the FDA. In addition to developing and working to scale-up a process for the manufacture of our silicon nitride ceramic products, we are also currently verifying a manufacturing process for our implant products that incorporate features of our CSC technology. We cannot assure you that we will be able to establish commercial-scale production of our products using cost-effective, reliable processes in facilities that meet applicable regulatory requirements. If we are unable to manufacture our products with consistent and satisfactory quality, at competitive costs, and sufficient quantities to meet demand, any of these circumstances may cause us to delay the introduction of our products or, once our products are introduced, may cause hospitals and surgeons to refrain from placing orders for them.

If we fail to comply with the FDA’s quality system regulation, the manufacture of our products could be delayed or interrupted and our products may be subject to product recalls.

We will be required to comply with the FDA’s quality system regulation, or QSR, which covers, among other things, the methods and documentation of the design, testing, production, control, quality assurance, labeling, packaging, sterilization, storage and shipping of our products. The FDA monitors compliance with the QSR through inspections of manufacturing facilities. If we are determined not to be in compliance or if any corrective action plan is not sufficient, we could be prevented or forced to delay the manufacture of our products, which could have a material adverse effect on our business, financial condition and results of operations. Moreover, after we have introduced products, any failure to maintain QSR compliance could force us to cease the manufacture of our products and subject us to other enforcement sanctions, including withdrawal of our products from the market, and delay or interrupt the manufacture of additional products.

We are in the process of developing a cost-effective process for the manufacture of our products based on our CSC technology, and if we are unable to implement such a process on a timely basis, we will experience delays in the introduction of our implant products that incorporate our CSC technology.

We are in the process of implementing an exclusively licensed process for the manufacture of our product candidates that will incorporate our CSC technology. We cannot assure you that we will succeed in our process implementation efforts for the manufacture of our product candidates that will incorporate our CSC technology. Delays in achieving a cost-effective and reliable process for commercial-scale production of implant products that incorporate our CSC technology could impede the introduction of those product candidates and would adversely affect our business.

We depend on a limited number of third-party suppliers for key raw materials used in our manufacturing processes, and the loss of these third-party suppliers or their inability to supply us with adequate raw materials could harm our business.

We rely on a limited number of third-party suppliers for the raw materials required for the production of our implant products that will be made using silicon nitride, and we currently are developing arrangements with secondary sources for these raw materials. Our dependence on a limited number of third-party suppliers and the challenges we may face in obtaining adequate supplies of raw materials involve several risks, including limited

12

control over pricing, availability, quality, and delivery schedules. We cannot be certain that our current suppliers will continue to provide us with the quantities of these raw materials that we require or satisfy our anticipated specifications and quality requirements. Any supply interruption in limited or sole sourced raw materials could materially harm our ability to manufacture our products until a new source of supply, if any, could be identified and qualified. Although we believe there are other suppliers of these raw materials, we may be unable to find a sufficient alternative supply channel in a reasonable time or on commercially reasonable terms. Any performance failure on the part of our suppliers could delay the development and commercialization of our implant products, including limiting supplies necessary for clinical trials and regulatory approvals, or interrupt production of then existing products that are already marketed, which would have a material adverse effect on our business.

If hospitals and other healthcare providers are unable to obtain coverage and adequate payments for procedures performed with our products, it is unlikely our products will be widely used.

Successful sales of our products will depend on the availability of coverage and adequate payments from third-party payors, including government programs such as Medicare and Medicaid, private insurance plans and managed care programs for procedures utilizing our future products. Hospitals and other healthcare providers that purchase orthopedic implant products for treatment of their patients generally rely on third-party payors to pay for all or part of the costs and fees associated with the procedures performed with or utilizing these devices. The existence of coverage and adequate payments for our products and the procedures performed with them by government and private insurance plans are central to acceptance of our lead and pipeline products. Many private payors currently base their reimbursement policies on the coverage decisions and payment amounts determined by the Centers for Medicare and Medicaid Services, or CMS, which administers the Medicare program. Others may adopt different coverage or payment policies for procedures performed with our products, while some governmental programs, such as Medicaid, have reimbursement policies that vary from state to state, some of which may not pay for the procedures performed with our products in an adequate amount, if at all. Our success may also be impacted by future action by CMS or other government agencies aimed at limiting payments to physicians, outpatient centers and hospitals. Additionally, as the portion of the U.S. population eligible for Medicare continues to grow, we will be more vulnerable to reimbursement limitations imposed by Medicare. For example, in 2006 CMS issued a national coverage decision denying Medicare coverage for DePuy’s CHARITE™ prosthetic intervertebral disc implant for patients over 60 years old. Also, the healthcare industry in the United States has experienced a trend toward cost containment as government and private insurers seek to control healthcare costs by paying service providers lower rates. Therefore, we cannot be certain that our products or the procedures performed with them will be covered or adequately reimbursed and thus we may be unable to sell our products profitably if third-party payors deny coverage or reduce their levels of payment below that which we project, or if our production costs increase at a greater rate than payment levels.

In addition, future reimbursement may be subject to international regulatory approval requirements and increased restrictions in international markets. Medical device regulatory requirements and healthcare payment systems vary significantly from country to country, and each country’s health care system may include both government sponsored healthcare and private insurance. Many countries have also instituted price ceilings on specific product lines. Any failure to receive regulatory and reimbursement approvals would negatively impact market acceptance of our products in any other international markets in which those approvals are sought.

We are dependent on our senior management team, engineering team, sales and marketing team and key surgeon advisors, and the loss of any of them could harm our business.

We have not entered into employment agreements with any of the members of our senior management team, and, therefore, there are no assurances that the services of any of these individuals will be available to us for any specified period of time. The loss of members of our senior management team, sales and marketing team, engineering team and key surgeon advisors, or our inability to attract or retain other qualified personnel or advisors could have a material adverse effect on our business, financial condition and results of operations.

13

Risks Related to Regulatory Approval of Our Products and Other Government Regulations

The safety of our products is not yet supported by any long-term clinical data, and they may prove to be less safe and effective than our laboratory data indicate.

We intend to seek clearance or approval for each of our lead and pipeline product candidates through the FDA’s 510(k) or PMA process depending on the product candidate. The 510(k) clearance process is based on the FDA’s agreement that a new product candidate is substantially equivalent to an already marketed product for which a PMA was not required and requires little or no additional supporting clinical data. Long-term clinical data or marketing experience obtained after clearance may indicate that our products cause unexpected complications or other unforeseen negative effects. If this happens, we could be subject to the withdrawal of our marketing clearance and other enforcement sanctions by the FDA, product recalls, significant legal liability, significant negative publicity, damage to our reputation and a dramatic reduction in our ability to sell our products, any one of which would have a material adverse effect on our business, financial condition and results of operations.

We expect to be required to conduct clinical trials for our pipeline product candidates. We have no experience conducting clinical trials, they may proceed more slowly than anticipated, and we cannot be certain that our products will be shown to be safe and effective for human use.

In order to commercialize our pipeline product candidates, we must submit a PMA for most of these product candidates, which will require us to conduct clinical trials. Even though we plan to seek FDA clearance of our pipeline Infinia Total Hip Implant product through the 501(k) process, the FDA has indicated that it expects us to conduct a clinical trial in support of our 510(k). We will receive approval from the FDA to commercialize pipeline products requiring a clinical trial only if we can demonstrate to the satisfaction of the FDA, in well-designed and properly conducted clinical trials, that our product candidates are safe and effective and otherwise meet the appropriate standards required for approval for specified indications. Clinical trials are complex, expensive, time consuming, uncertain and subject to substantial and unanticipated delays. Before we may begin clinical trials, we must submit and obtain approval for an investigational device exemption, or IDE, that describes, among other things, the manufacture of, and controls for, the device and a complete investigational plan. Clinical trials generally involve a substantial number of patients in a multi-year study. We may encounter problems with our clinical trials and any of those problems could cause us or the FDA to suspend those trials, or delay the analysis of the data derived from them.

A number of events or factors, including any of the following, could delay the completion of our clinical trials in the future and negatively impact our ability to obtain FDA approval for, and to introduce a particular pipeline product candidate:

| • | failure to obtain approval from the FDA or any foreign regulatory authority to commence an investigational study; |

| • | conditions imposed on us by the FDA or any foreign regulatory authority regarding the scope or design of our clinical trials; |

| • | delays in obtaining or in our maintaining required approvals from institutional review boards or other reviewing entities at clinical sites selected for participation in our clinical trials; |

| • | insufficient supply of our pipeline product candidates or other materials necessary to conduct our clinical trials; |

| • | difficulties in enrolling patients in our clinical trials; |

| • | negative or inconclusive results from clinical trials, or results that are inconsistent with earlier results, that necessitate additional clinical studies; |

14

| • | serious or unexpected side effects experienced by patients in whom our pipeline product candidates are implanted; or |

| • | failure by any of our third-party contractors or investigators to comply with regulatory requirements or meet other contractual obligations in a timely manner. |

Our clinical trials may not begin as planned, may need to be redesigned, and may not be completed on schedule, if at all. Delays in our clinical trials may result in increased development costs for our product candidates, which could cause our stock price to decline and limit our ability to obtain additional financing. In addition, if one or more of our clinical trials are delayed, competitors may be able to bring products to market before we do, and the commercial viability of our product candidates could be significantly reduced.

Once our products are commercialized, we and our independent sales agents must comply with various federal and state anti-kickback, self-referral, false claims and similar laws, any breach of which could cause a material adverse effect on our business, financial condition and results of operations.

Once our products are commercialized, our relationships with surgeons, hospitals and the marketers of our products will become subject to scrutiny under various federal anti-kickback, self-referral, false claims and similar laws, often referred to collectively as healthcare fraud and abuse laws. Healthcare fraud and abuse laws are complex, and even minor, inadvertent violations can give rise to claims that the relevant law has been violated. Possible sanctions for violation of these fraud and abuse laws include monetary fines, civil and criminal penalties, exclusion from federal and state healthcare programs, including Medicare, Medicaid, Veterans Administration health programs, workers’ compensation programs and TRICARE (the healthcare system administered by or on behalf of the U.S. Department of Defense for uniformed services beneficiaries, including active duty and their dependents, retirees and their dependents), and forfeiture of amounts collected in violation of such prohibitions. Certain states in which we intend to market our products have similar fraud and abuse laws, imposing substantial penalties for violations. Any government investigation or a finding of a violation of these laws would likely result in a material adverse effect on the market price of our common stock, as well as our business, financial condition and results of operations.

Anti-kickback laws and regulations prohibit any knowing and willful offer, payment, solicitation or receipt of any form of remuneration in return for the referral of an individual or the ordering or recommending of the use of a product or service for which payment may be made by Medicare, Medicaid or other government-sponsored healthcare programs. We have entered into consulting agreements and product development agreements with surgeons, including some who may make referrals to us or order our products after our products are introduced to market. In addition, some of these surgeons own our stock, which they purchased in arms’ length transactions on terms identical to those offered to non-surgeons, or received stock options from us as consideration for consulting services performed by them. Other surgeons may be offered shares as part of this offering under our directed share program as described in the “Underwriters” section of this prospectus. While these transactions were structured with the intention of complying with all applicable laws, including the federal ban on physician self-referrals, commonly known as the “Stark Law,” state anti-referral laws and other applicable anti-kickback laws, it is possible that regulatory or enforcement agencies or courts may in the future view these transactions as prohibited arrangements that must be restructured or for which we would be subject to other significant civil or criminal penalties, or prohibit us from accepting referrals from these surgeons. Because our strategy relies on the involvement of surgeons who consult with us on the design of our product candidates, we could be materially impacted if regulatory or enforcement agencies or courts interpret our financial relationships with our surgeon advisors who refer or order our products to be in violation of applicable laws and determine that we would be unable to achieve compliance with such applicable laws. This could harm our reputation and the reputations of our surgeon advisors. In addition, the cost of non-compliance with these laws could be substantial since we could be subject to monetary fines and civil or criminal penalties, and we could also be excluded from federally-funded healthcare programs, including Medicare and Medicaid, for non-compliance.

The scope and enforcement of all of these laws is uncertain and subject to rapid change, especially in light of the lack of applicable precedent and regulations. There can be no assurance that federal or state regulatory or

15

enforcement authorities will not investigate or challenge our current or future activities under these laws. Any investigation or challenge could have a material adverse effect on our business, financial condition and results of operations. Any state or federal regulatory or enforcement review of us, regardless of the outcome, would be costly and time consuming. Additionally, we cannot predict the impact of any changes in these laws, whether these changes are retroactive or will have effect on a going-forward basis only.

We face significant uncertainty in the industry due to government healthcare reform.

Political, economic and regulatory influences are subjecting the healthcare industry to fundamental changes. Reforms under consideration in the United States include mandated basic healthcare benefits, controls on healthcare spending, increases in insurance premiums and increased out-of-pocket requirements for patients, the creation of large group purchasing organizations that aim to reduce the costs of products that their member hospitals consume, and significant modifications to the healthcare delivery system. We anticipate that the U.S. Congress and state legislatures will continue to review and assess alternative healthcare delivery systems and payment methods. Due to uncertainties regarding the ultimate features of reform initiatives and the timing of their enactment and implementation, we cannot predict which, if any, of such reform proposals will be adopted, when they may be adopted or what impact reform initiatives may have on us.

Risks Related to Our Intellectual Property and Litigation

If the combination of patents, trade secrets and contractual provisions that we rely on to protect our intellectual property is inadequate, our ability to commercialize our orthopedic implants successfully will be harmed, and we may not be able to operate our business profitably.

Our success depends significantly on our ability to protect our proprietary rights to the technologies incorporated in our products. We currently have four issued U.S. patents, twelve pending U.S. patent applications, and ten pending foreign patent applications. We rely on a combination of patent protection, trade secret laws and nondisclosure, confidentiality and other contractual restrictions to protect our proprietary technology. However, these may not adequately protect our rights or permit us to gain or keep any competitive advantage.

The issuance of a patent is not conclusive as to its scope, validity or enforceability. The scope, validity or enforceability of our issued patents can be challenged in litigation or proceedings before the U.S. Patent and Trademark Office, or the USPTO. In addition, our pending patent applications include claims to numerous important aspects of our products under development that are not currently protected by any of our issued patents. We cannot assure you that any of our pending patent applications will result in the issuance of patents to us. The USPTO may deny or require significant narrowing of claims in our pending patent applications. Patents issued as a result of the pending patent applications, if any, may not provide us with significant commercial protection or be issued in a form that is advantageous to us. Proceedings before the USPTO could result in adverse decisions as to the priority of our inventions and the narrowing or invalidation of claims in issued patents. The laws of some foreign countries may not protect our intellectual property rights to the same extent as the laws of the United States, if at all.

Our competitors may successfully challenge and invalidate or render unenforceable our issued patents, including any patents that may issue in the future, which could prevent or limit our ability to market our products and could limit our ability to stop competitors from marketing products that are substantially equivalent to ours. In addition, competitors may be able to design around our patents or develop products that provide outcomes that are comparable to our products but that are not covered by our patents.

We also rely on an exclusive license from Dytech Corporation Ltd., or Dytech, for rights under three patents relating to a manufacturing process that can be used to implement our CSC technology. Our exclusive license from Dytech will be in effect for as long as we continue to have payment obligations to Dytech under the license,

16

unless the license is earlier terminated on account of a continuing material violation of the license agreement. In the event of an early termination, we would not be able to rely on Dytech’s patents for the manufacturing process for the implementation of our CSC technology, and our ability to manufacture and commercialize our products incorporating this technology would be significantly impacted in an adverse manner.

Further, in the event that we are not able to commercialize a product or product candidate incorporating the licensed technology from Dytech within three years of the effective date of the agreement, or December 20, 2009 (or four years in the event clinical trials are required for FDA clearance, or December 20, 2010), Dytech will have the right, upon thirty days prior written notice to us, to convert the exclusive license into a non-exclusive license. In the event that our exclusive license is converted into a non-exclusive license, other competitors may be able to obtain licenses similar to ours that would substantially impair our ability to prevent competitors from commercializing products similar to ours.

We have also entered into confidentiality and assignment of intellectual property agreements with certain of our employees, consultants and advisors as one of the ways we seek to protect our intellectual property and other proprietary technology. However, these agreements may not be enforceable or may not provide meaningful protection for our trade secrets or other proprietary information in the event of unauthorized use or disclosure or other breaches of the agreements.

In the event a competitor infringes upon one of our patents, our licensed patents or other intellectual property rights, enforcing our rights may be difficult, time consuming and expensive, and would divert management’s attention from managing our business. There can be no assurance that we will be successful on the merits in any enforcement effort. In addition, we may not have sufficient resources to litigate, enforce or defend our intellectual property rights.

We have no patent protection covering the composition of our formulation of silicon nitride or the process we use for manufacturing silicon nitride, and competitors may create doped-silicon nitride implant products substantially similar to ours, which could significantly diminish the effect of any competitive advantages that we might otherwise have had.

The composition of silicon nitride formulated with dopants such as yttira and alumina is generally known or is readily knowable, and we have no patent protection either for the composition of our formulation of silicon nitride, which we refer to as MC2, or for the process of manufacturing our MC2 silicon nitride and implant products made from that material. Moreover, we are aware of at least one ceramic manufacturer that already has the capability of manufacturing silicon nitride with strength, fracture resistance, and wear resistance characteristics similar to our MC2 silicon nitride. If other orthopedic companies decide to compete with us by manufacturing implants made from silicon nitride, or by marketing implants with silicon nitride components purchased from suppliers, we will have no ability to prevent them from doing so, except to the extent that specific implant embodiments are covered by our issued patents. To date, we have been issued one U.S. patent related to our MC2 technology, directed to the use of silicon nitride, with certain flexural strength and toughness characteristics, in the concave component of an articulating implant, where the convex component is made of a cobalt chromium metal alloy. Although we have submitted patent applications directed to other implant embodiments, such as an articulating implant where the concave component is made of a cobalt chromium metal alloy and the convex component is made of silicon nitride, or where both the concave and convex components are made of silicon nitride, there is no assurance that such applications will issue as patents. If we fail to obtain patents with claims of a scope necessary to cover the various embodiments of orthopedic implants we intend to develop, our competitors will have the right to seek to develop and market substantially similar orthopedic implants made of silicon nitride. We are aware of one other company that appears to be developing at least one implant component made from silicon nitride, and we cannot assure you that our competitors will not seek to develop and market orthopedic implants made of silicon nitride in the future. The introduction by our competitors of orthopedic implants made from silicon nitride could negatively impact our ability to maintain a competitive advantage based on our MC2 technology, particularly if such competitive silicon nitride implants possessed strength, fracture resistance, wear resistance and imaging characteristics similar to our MC2 silicon nitride.

17

We continue to develop and refine our manufacturing processes to produce silicon nitride implants, and we believe we have already developed, and will continue to develop, significant know-how related to these processes. However, there is no assurance that we will be able to maintain this know-how as trade secrets, and competitors may develop or acquire equally valuable or more valuable know-how related to the manufacture of silicon nitride implants. Further, if any of our competitors is able to obtain patent protection for its composition of silicon nitride or for its process for manufacturing silicon nitride, we could become subject to patent infringement claims and further be prevented from continuing the manufacture of our silicon nitride based implant products.

We could become subject to intellectual property litigation that could be costly, result in the diversion of management’s time and efforts, require us to pay damages, prevent us from marketing our product candidates under development, and/or reduce the margins we may realize from our products that we may commercialize.

The medical devices industry is characterized by extensive litigation and administrative proceedings over patent and other intellectual property rights. Whether a product infringes a patent involves complex legal and factual issues, and the determination is often uncertain. There may be existing patents of which we are unaware that our products under development may inadvertently infringe. The likelihood that patent infringement claims may be brought against us increases as the number of participants in the market for spine, hip and knee implants increases and as we achieve more visibility in the market place and introduce products to market.

Any infringement claim against us, even if without merit, may cause us to incur substantial costs, and would place a significant strain on our financial resources, divert the attention of management from our core business, and harm our reputation. In some cases, litigation may be threatened or brought by a patent holding company or other adverse patent owner who has no relevant product revenues and against whom our patents may provide little or no deterrence. If we were found to infringe any patents, we could be required to pay substantial damages, including triple damages if an infringement is found to be willful, and royalties and could be prevented from selling our products unless we obtain a license or are able to redesign our products to avoid infringement. We may not be able to obtain a license enabling us to sell our products on reasonable terms, or at all, and there can be no assurance that we would be able to redesign our products in a way that would not infringe those patents. If we fail to obtain any required licenses or make any necessary changes to our technologies or the products that incorporate them, we may be unable to commercialize one or more of our products or may have to withdraw products from the market, all of which would have a material adverse effect on our business, financial condition and results of operations.

In addition, in order to further our product development efforts, we have entered into agreements with orthopedic surgeons to help us design and develop new products, and we expect to enter into similar agreements in the future. In certain instances, we have agreed to pay such surgeons royalties on sales of products which incorporate their product development contributions. There can be no assurance that surgeons with whom we have entered into such arrangements will not claim to be entitled to a royalty even if we do not believe that such products were developed by cooperative involvement between us and such surgeons. In addition, some of our surgeon advisors have agreements with other orthopedic companies pursuant to which they have agreed to assign to those other companies their rights in inventions which they conceive or develop, or help conceive or develop. There can be no assurance that one or more of these orthopedic companies will not claim ownership rights to an invention we develop in collaboration with our surgeon advisors or consultants on the basis that an agreement with such orthopedic company gives it ownership rights in the invention. Any such claim against us, even without merit, may cause us to incur substantial costs, and would place a significant strain on our financial resources, divert the attention of management from our core business and harm our reputation.

If our ceramic technologies or our product candidates conflict with the rights of others, we may not be able to manufacture or market our product candidates, which could have a material and adverse effect on us.

Our commercial success will depend in part on not infringing the patents or violating the other proprietary rights of third parties. We are aware of an issued patent that was recently granted to DePuy by the European Patent Office (EP 1212013) based on international patent application no. WO 01/17464, entitled “Combination

18

of Material for Joint Prosthesis” (the “EP ’013 patent”). The EP ’013 patent was granted for nineteen different designated European states and claims an orthopedic joint prosthesis having metal on ceramic articulating surfaces, wherein the hardness of the metallic material is at least about 2500 MPa, and the hardness of the ceramic material is greater than that of the metallic material by at least about 4000 MPa, where the articulating surfaces have sphericity not more than 0.01 microns and surface roughness more than 0.05 microns.

We are aware that several third parties, including Biomet UK Ltd, have filed post-grant oppositions to the EP ’013 patent raising objections as to its scope and validity. An opposition is a proceeding that allows third parties to challenge the validity of a European patent granted by the European Patent Office. There can be no assurances that any of these oppositions will be successful, although in the majority of cases, the European patents concerned are at least reduced in scope. Three possible outcomes are: (i) some or all of the claims survive the opposition as issued; (ii) some or all of the claims are narrowed; and/or (iii) some or all of the claims are held invalid. We are monitoring this situation closely. Final resolution of the opposition proceedings (including any appeals) may take a number of years. If this patent is not held invalid or limited in scope, and if our activities are determined to be covered by the patent, we cannot provide any assurance that DePuy would be willing to grant us a license on terms we or they would consider commercially reasonable, if at all. As a consequence, we could be prevented from manufacturing and marketing high-strength ceramic-on-metal articulating implants in the European countries where the European patent remains in force, which would have a material and adverse effect on our business, financial condition and results of operations.